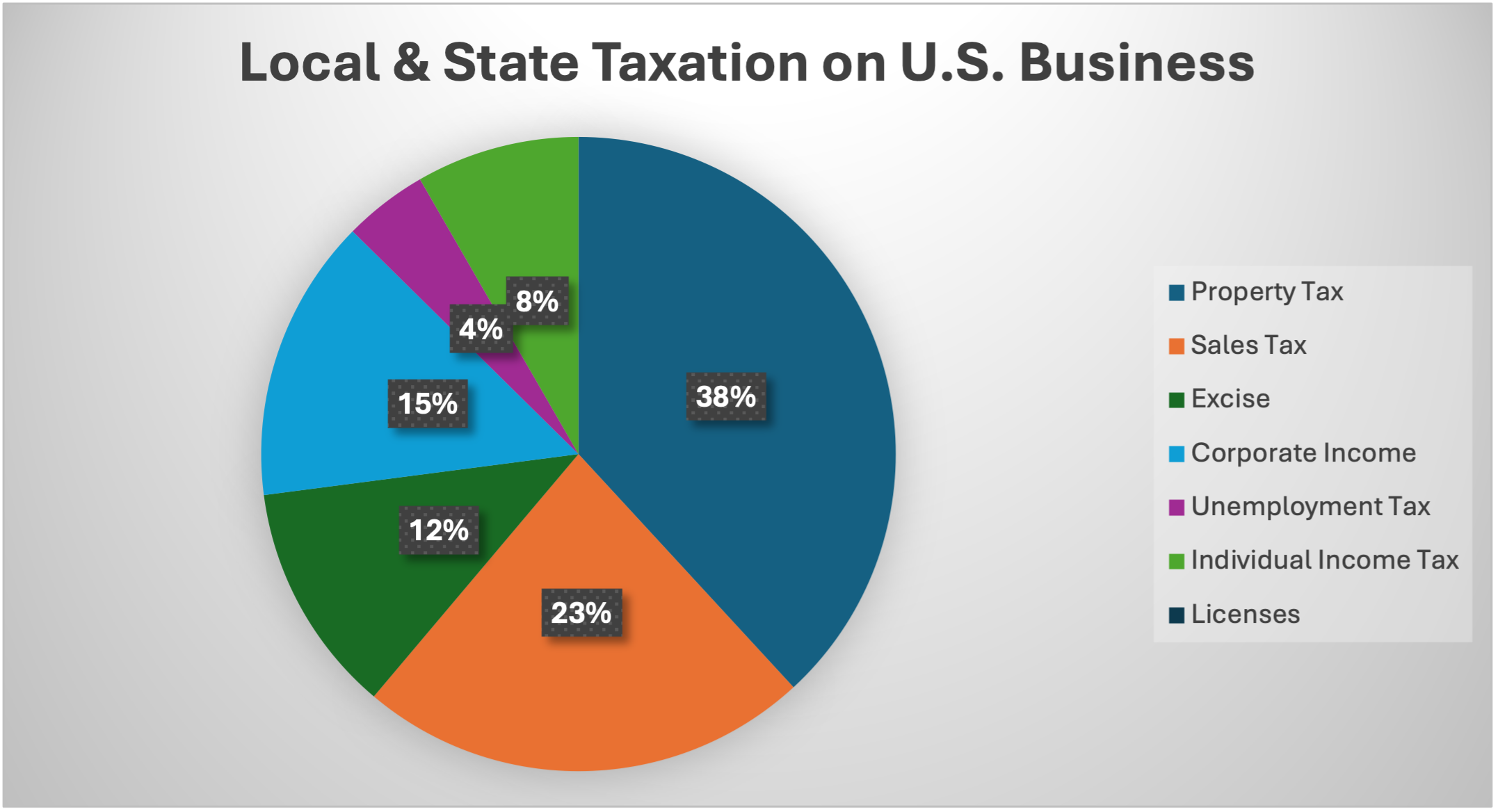

Few industries are as sensitive to tax policy and incentives as data centers. Other than needing a small number of highly skilled high-tech workers, these facilities need a location safe from natural disaster, with reliable and affordable electric rates and water, and a competitive tax structure. Data centers pay substantial sales and property taxes based upon the high cost of the technology and equipment that operates within the walls of these 21st Century industrial facilities. Unfortunately, these two tax categories remain the prime local and state taxes paid by U.S. companies according to the Council for State Taxation as illustrated by the pie chart below.

According to the Tax Foundation, most states exempt manufacturing machinery from their sales tax other than Alabama, Hawaii, Kentucky, Mississippi, Nevada, New Mexico, North Dakota, South Dakota, and the District of Columbia.[i] In most states, businesses not only pay taxes on their real property (land and structures), but also on their machinery, equipment, fixtures, and supplies, which are classified as tangible personal property (TPP).[ii] Arizona, Colorado, Idaho, Indiana, Michigan, Montana, and Rhode Island have TPP tax de minimis exemptions of $50,000 or more, while Florida, Georgia, Kentucky, and Utah have lower exemptions.[iii] Ohio, New Mexico, Pennsylvania, New York, New Hampshire, New Jersey, Delaware, Illinois, Wisconsin, Iowa, Minnesota, North Dakota and South Dakota all fully exempt TPP from taxation providing a substantial benefit to data center development.[iv] 19 states offer some form of property tax abatements data centers can attempt to gain through a corporate site location process. Sales tax is another substantial cost center for both the operation and construction of data centers, and many states offer aggressive economic development incentives to address their high sales tax costs which often provide revenue for local and state governments.

Data centers also benefit from state economic development incentives in half the states in the union. As most data centers are not “worker heavy” traditional state data center tax incentives are not focused on the job creation tax credits used for other industries but instead address sales and property taxes, construction, and electricity costs. Data centers may be eligible for local or state economic development incentives depending upon the state law. Most are focused on the size of the capital investment as the prime trigger for local and state data center tax incentive eligibility. 25 states offer some form of local and/or state economic development incentive to encourage the growth of data centers. The list below outlines the existing local and state data center tax incentive programs.

Local and State Data Center Tax Incentive Programs

Most states across the United States are using economic development incentives to recruit data centers to their marketplace through tax credits, exemptions, and abatements.

[1] https://taxfoundation.org/data/all/state/state-tax-manufacturing-machinery-2019/

[1] https://taxfoundation.org/data/all/state/state-tangible-personal-property-taxes-2024/

[1] Ibid.

[1] Ibid.