California’s high tax rates and cost of living will continue to drive companies and their executives out of the Golden State to greener pastures in the Desert Southwest and beyond in 2021. The high profile move of Elon Musk, successful serial entrepreneur, from California to Texas due to the tax burden of the Golden State illustrates the danger high-tax states face. California which was a post-World War II success story riding the success of mega cities like Los Angeles and San Francisco and as the home of the world’s technology industry is showing its age. Lower cost markets in Arizona, Nevada and Utah have for years been gaining a massive influx of California companies and residents. COVID 19 and a shift by technology companies to a work from home model are dramatically increasing the exit from the California marketplace. Just as the Industrial Midwest has spent the last thirty years losing its manufacturing base to lower cost markets in the South, the Desert Southwest is eating California’s lunch with 1/3 of Phoenix’s new attraction projects coming from California and Telsa, HP and others expanding in Texas.

First, let us look at the cost of living in California. Silicon Valley is a global technology powerhouse but the cost of living for workers is unbearable. The Census Bureau reports the average cost of a home in the city of Palo Alto, California (the unofficial capital of Silicon Valley) is over $2,000,000—ten times the national average. While the median household wage in Palo Alto is three times the national average this simply does not permit the average college educated worker in Northern California to afford to live the American Dream by buying a house. Even more troubling is the average resident rent in Palo Alto is over $2500 a month which is double the national average. Spurred on by COVID 19, tech companies in Northern California have set their employees loose to work remotely elsewhere in the United States. If their employees move to more affordable regions, why would the companies remain in Northern California.

California’s high cost of living is further complicated by the state’s incredible tax burden placed on companies and entrepreneurs. All local and state governments enact tax policy to pay for schools, colleges and universities, roads, water, sewer, and social services that create the quality-of-life workers and business owners seek during a corporate site location review. Not all states are created equal when it comes to government spending which impact the overall tax burden companies and individuals face in a region. A study by the firm 24/7 Wall St. found that Florida, Indiana, Tennessee, Idaho, Arkansas have the lowest local and state government spending on a per capita basis. Alaska, Wyoming, New York, Washington, and California are on the other end of the scale of having the highest per capita spending for local and state governments. States and regions that spend less on a per capita basis are generally more attractive to companies considering a corporate site location project.

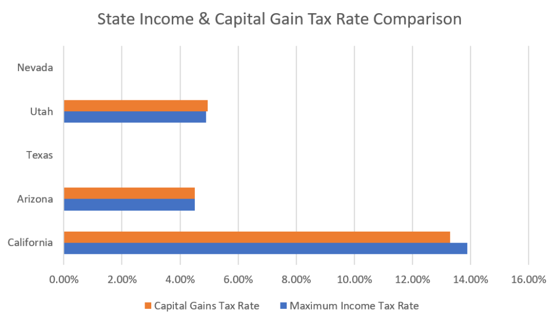

What a region or state taxes impacts a corporate site location project, and this analysis is generally very industry specific. Regions and states may tax income, property, sales transactions, or specific activities or industries through insurance premium taxes, tobacco or alcohol or hospitality activities through excise taxes, and utility service excise taxes. Different industries are impacted by local and state tax policy in different ways. Successful entrepreneurs will be focused on income tax and capital gains tax at the state level. As the chart below illustrates, California’s highest marginal income tax and capital gains tax rate of over 13% creates a major disincentive for successful tech company leaders to remain when compared to all Desert Southwest states especially Texas and Nevada that do not have either tax at all.

Data centers are capital intensive and use a substantial amount of energy and water. Property and sales tax rates are prime drivers for data center corporate site location projects. Logistics and fulfillment centers house business inventory and are property rich from a tax standpoint. Property taxes are going to be a prime concern for this industry. Advanced services and tech companies are people intensive with generally higher than average wage rates. These projects are going to be more sensitive to local and state income tax rates. Local and state policy makers can shape their tax code to focus on the industries they want to locate in their region just as they can with economic development incentives. However, many regions and states fall into the trap of taxing everything that creates a substantial economic disadvantage.

The Council for State Taxation releases an important report about the business tax burden placed on companies by regions and states that is worthy of review. In 2019, according to the most recent COST Business Tax Burden report, business property taxes increased for the ninth year in a row since 2010. Almost half of the $14.8 billion in increased property tax revenue came from gains in four large states: Texas ($2.3 billion), California ($2.0 billion), New York ($1.4 billion) and Florida ($1.0 billion). Nationally, business property tax revenue increased by an average of 4.9%, but for 33 states, this revenue grew at a slower rate. Texas had the largest dollar increase in business property tax revenue, collecting $2.3 billion more than in 2018. Washington had the highest growth rate for business property tax revenue, increasing by 15.4%. Sales tax is another substantial cost center for both the operation and construction of data centers, and many states offer aggressive economic development incentives to address their high sales tax costs which often provide revenue for local and state governments. From 2019 to 2020, the state with the largest gain in sales tax collections on business inputs was California, which saw an increase of over $3.6 billion. Of the 45 states with a state sales tax, 42 experienced an increase in sales tax collections on business inputs. Washington DC also experienced an increase in sales tax collections on business inputs. Traditional high-cost states like California, New York and Illinois have substantial sales and property taxes in place as well as every other tax government can think of. Texas and Florida’s very high sales and property tax illustrates the downside of not having a state or local income tax.

What activity is taxed and how much in taxes a region and state charges businesses all impact the decision by a company as to where to locate through a corporate site location process. Regions cannot build California’s mountains, desert or ocean or change their weather, but they can restrain the cost of government, enact a business-friendly tax code focused on the industry they want to recruit and keep business tax rates low to attract new industry. California’s unique topography and mild weather cannot simply make up for the high costs imposed by their local and state government as well as the rising cost of living. California companies will continue to turn famous 19th Century newspaper publisher Horace Greeley’s advice on its head by “going east” in 2021.