Taxes levied by local and state governments have a major impact on a company’s corporate site location decisions. What and how much a local or state government may tax businesses is a policy decision related to the revenues needed to pay for schools, roads, water, public safety, and other essential services, but is also a public policy decision impacting a company’s corporate site location.

Source: Council of State Taxation

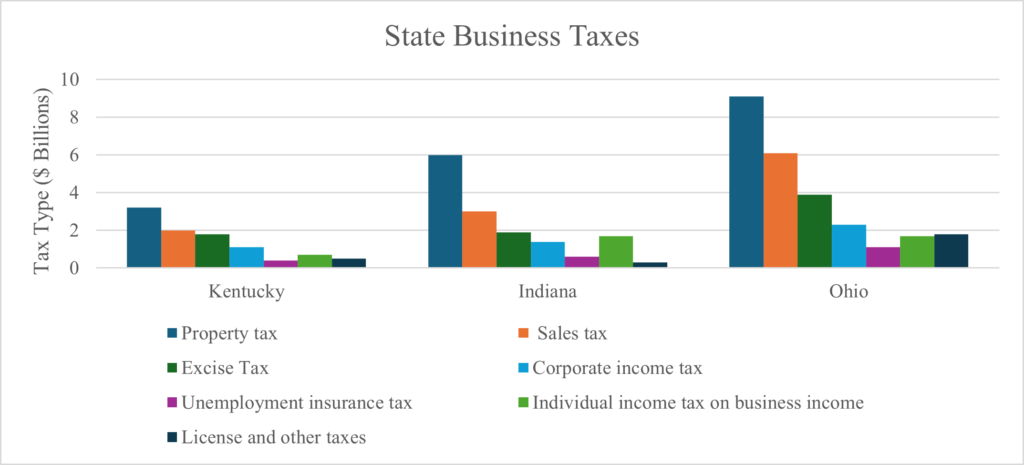

Property taxes are the highest business tax in nearly all the states and all these states have some form of an income tax. An important factor for companies to consider when reviewing this state and local tax data is what taxes will their company pay more. Large-scale industrial investments will drive up property taxes if the state taxes equipment. Some states have property taxes on inventory which impacts individual companies differently. Finally, companies in the advanced service, white collar, or technology industries may not put a heavy emphasis on property tax as they have moved to a near virtual office presence and won’t pay substantial property taxes.

A comparison of state and local tax policy in Indiana, Kentucky and Ohio offers an illustration as to how different tax policy impacts different industries differently. As the table below illustrates, property taxes are the dominant taxes most companies pay in Kentucky, Indiana, and Ohio and all these states under review operate with some form of income tax which spreads the tax burden to individual taxpayers and away from many businesses.

Source: Council of State Taxation

Property taxes have a large impact on commercial development—as the chart above illustrates property taxes are companies largest tax bill. According to the Council on State Taxation, taxes on both real and personal property are the largest source of state and local tax revenue. Complicating matters for companies, in general, property taxes are increasing nationwide, doubling in some markets between 2021 and 2022, according to a recent study from ATTOM Data Solutions, a real estate research firm. High property taxes act as a disincentive for making large capital investments and new job creation projects as they likely will drive the price of the property higher when it is reappraised.

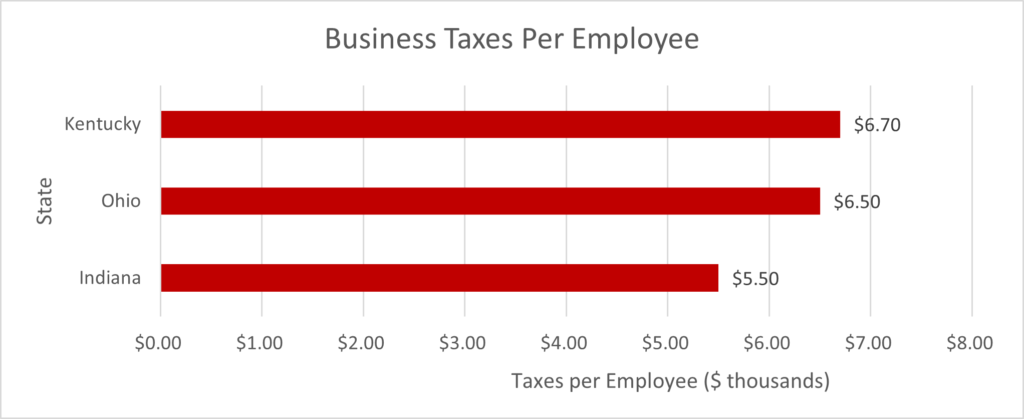

Source: Council of State Taxation

Measuring business taxes on a per-employee basis is a method that can provide a company considering a corporate site location project with a good basis for a state’s overall business-friendly attitude. This approach addresses population differences in the states. As the table above illustrates, Kentucky companies share the highest burden of state and local taxes when compared with Indiana, and Ohio but the Buckeye state is not far behind. Indiana is a leader in low taxes for local businesses. All three of these states utilize an income tax that impacts a companies workers which helps spread the tax burden away from companies to fund the general operation of government.

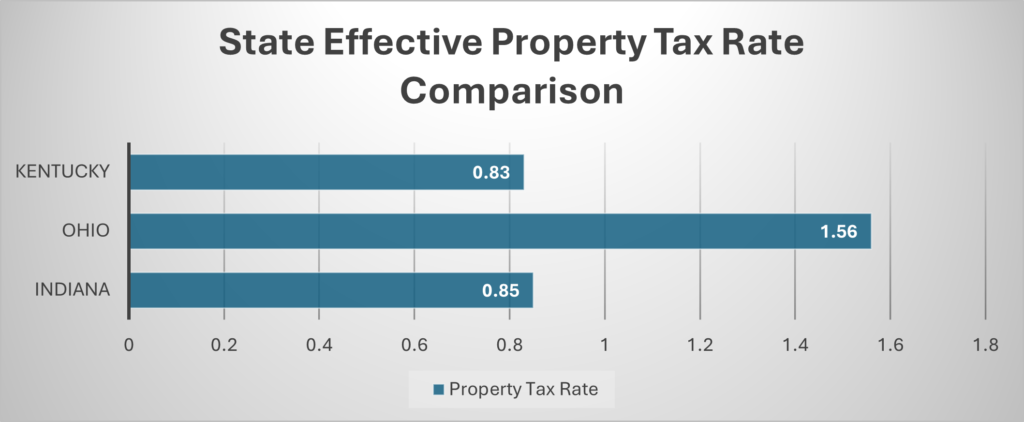

Source: Rocket Mortgage

Even though Kentucky has a higher overall tax rate for business, Ohio is the unfortunate winner when it comes to comparing the state to Indiana and Kentucky for the state’s effective property tax rate. A challenge Ohio faces in the growth of their property tax relates to the growth of Inside Millage taxes. Ohio property taxes are made up of 2 main parts: Inside Millage and Outside Millage. A mill is $1 of tax for $1,000 of property value, and Outside Millage is the majority of the cost of local property tax bills and is subject to voter approval.[i] This is the part of local property tax bills that is voted on to support schools, senior services, the port authority, developmental disabilities and other local agencies.[ii] Inside Millage is set by your municipality and is not subject to voter approval but Inside Millage cannot exceed 10 mills.[iii] When your property value changes, Outside Millage cannot exceed the dollar amount that was originally passed at the ballot box, even when property values increase.[iv] This means that as property values go up, the effective millage rate goes down but the funding for local taxing agencies remains as it was voted. When property values change, Inside Millage increases at a proportional rate to your property value. Recent increases in property taxes driven often by a lack of housing supply may be driven by the lack of inflation control on Inside Millage as well as inflation driving up the costs for the delivery of local services funded by property taxes as well as impacting property valuations. Governing magazine reported that voters in half a dozen states approved ballot issues aimed at lowering property taxes by cutting taxes for some or all property owners passed in Arizona, Florida, Georgia, New Mexico, Virginia and Wyoming.[v]

Tax policy decisions by local and state governments can create a competitive advantage or disadvantage for companies trying to decide where to create high-wage jobs and capital investments.

[i] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://co.lucas.oh.us/DocumentCenter/View/88673/Inside-Millage-Calculation

[ii] Ibid.

[iii] Ibid.

[iv] Ibid.

[v] https://stateline.org/2024/11/08/voters-in-several-states-support-reducing-property-taxes/