Communities across the U.S. have achieved economic development success through the creation and implementation of economic development plans. The Montrose Group has completed over 50 economic development studies addressing a range of issues and a couple of successful case studies are below.

Athens County, Ohio is an Appalachian County in Southeastern Ohio and is home to Ohio University, a 20,000-student state university. In 2017, the Athens County Economic Development Council, a public-private-partnership that leads economic development in the county, engaged the Montrose Group to create a comprehensive economic development plan. Key action items recommended and achieved by 2021 included:

- Working with the City of Athens to establish three Downtown Redevelopment Districts.

- Implementing a more robust Business Retention & Expansion program with OhioSE, and these BR&E efforts generated total compensation impact of $36,000,000.

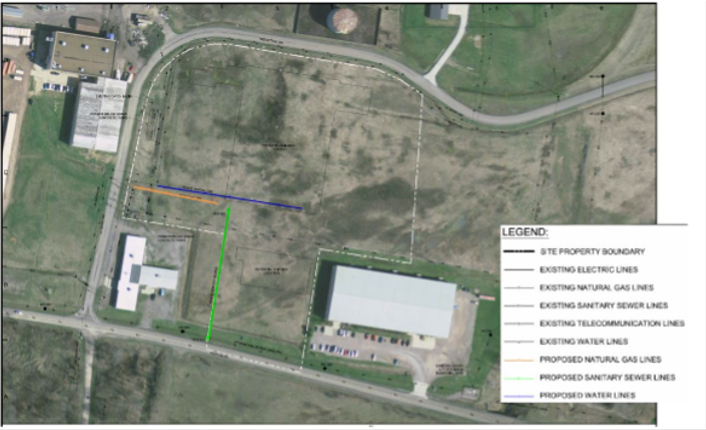

- Development of the Thiesen Industrial Park Site by having all ground studies completed through grant funding, an RFP was released, and a firm selected for the architecture and engineering of two speculative building, and the attraction of grant funding from JobsOhio for infrastructure funding.

- Assisting OU with the Ridges site development plan and the identification and recruitment of developers.

- Securing over $3,000,0000 from state & federal sources, which supported companies and funded business infrastructure improvements needed to facilitate job retention & creation.

Since Athens County created its economic development strategic plan in 2017 the county has seen a drop of 8% in its poverty rate. While there is more work to do, the Athens County Economic Development Council is a clear economic development plan winner.

In 2022, the cities of Adrian and Tecumseh, Michigan were looking to create a Michigan Smart Zone to promote industrial development in their communities. Michigan’s Smart Zones provide distinct geographical locations where technology-based firms, entrepreneurs and researchers locate near all the community assets that assist in their endeavors, and a SmartZone Local Development Finance Authority (LDFA) can be created to allow property tax dollars to be captured and reinvested to provide support to high-technology entrepreneurs, businesses and researchers in our local community. The Adrian and Tecumseh, Michigan communities came together to engage the Montrose Group to develop a Smart Zone economic development plan.

A seven-step action plan was crafted that suggested:

- Implementing the Adrian – Tecumseh SmartZone Industrial Site Development Marketing and Outreach Strategy around leading industry sectors which include Advanced Manufacturing, Automotive Supply Chain, Chemical Manufacturing, and Logistics & Distribution.

- Aligning with state of Michigan industry sector priorities and leverage Detroit Regional Partnership, Michigan Economic Development Corporation, and Consumers Energy to implement business attraction strategies.

- Leveraging state and local economic development programs that deliver a competitive incentive package while ensuring mutually beneficial investments made by the communities and companies to ensures preservation of a competitive business climate and long-term economic benefit for all parties.

- Utilizing new electricity infrastructure investments made by Consumers Energy to attract high energy users to SmartZone sites.

- Working with its partners to facilitate and coordinate a strategy to promote and integrate STEM Workforce Programs that retain and attract the next generation of talent to fill the workforce pipeline and support existing business hiring needs and demonstrate an availability of workforce for business attraction target industries.

- Working with LenaweeNow on a resident recruitment effort to meet the employment needs of Adrian and Tecumseh employers.

- Establishing and coordinating a C-level executive roundtable initiative that brings together local business leaders to benchmark and share ideas.

The Adrian-Tecumseh Smart Zone has two community industrial parks, support for tech companies and a strong start in implementing this strategy.

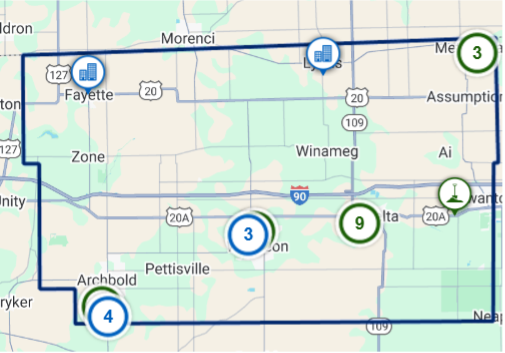

In 2020, Fulton County, Ohio was another community seeking to retain and attract more high-wage manufacturing jobs in this Northwest Ohio community strategically connected to Toledo and just south of the Detroit metro region. The Montrose Group was engaged to craft an industrial site development plan that suggested the following action steps after defining the industries likely to locate in Fulton County based upon its strategic location, workforce and sites:

- Prepare three sites for the attraction of Primary metal manufacturing, Food processing and Indoor agriculture, Machinery manufacturing, Fabricated metal product manufacturing, and Logistics & Distribution as highest and best uses for sites.

- Prepare two sites for the attraction of Primary Metal Manufacturing, Machinery Manufacturing, and Fabricated Metal Product Manufacturing.

- Leverage RGP, JobsOhio and First Energy to launch an attraction and marketing campaign aimed at the attraction of Primary Metal Manufacturing, Food Processing and Indoor Agriculture, Machinery Manufacturing, Fabricated Metal Product Manufacturing, and Logistics & Distribution.

- Fulton County Economic Development Corporation should work with existing property owners to get development control of the sites.

- Fulton County Economic Development Corporation and its partners should pursue state and federal funding to fund infrastructure improvements in the Industrial Corridor.

- Use local, state and federal funding programs to prepare sites for industrial development.

Fulton County now has nine industrial sites they promote for manufacturing investment. Fulton County has seen recent industrial growth. In 2021, Nova Tube & Steel announced the installation of two new tube mills in Delta, Ohio creating 100 new jobs with a $70 M investment. In 2022, North Star BlueScope Steel in Delta, Ohio, marked the plant’s US$700 million facility expansion that will create more than 100 new jobs and will increase annual hot rolled coil production by 850,000 metric tons. Nature Fresh Farms whose 2015 $170 M greenhouse continues to grow with a greenhouse addition growing strawberries in Delta.

Fostoria, Ohio had a closed school that had no plan for reuse. This rural Northwest Ohio city also has a retail service gap. The Montrose Group was engaged to conduct a retail market analysis for the Fostoria Economic Development Corporation as part of an effort to collect and analyze data to drive new commercial and retail development opportunities on the former St. Wendelin School site and within the City of Fostoria. The report examined consumer characteristics and market segmentation, retail leakage (gaps in the current retail market), and retail business potential. A retail market analysis is an important foundational element to building a comprehensive site development effort for properties envisioned for retail and mixed-use development, identifying retail market conditions and trends within a local community and broader region (market area). In theory, retail development “follows the rooftops” to communities with demographics that fit the consumer market segment of a retailer and show promise of growing profits, however in smaller communities that can be overlooked for more densely populated areas, the need for retail market analysis becomes more important to understanding specific areas where retail opportunities exist, consumer demands need to be met, and targeted retail audiences can be pursued. A retail business attraction strategy for mid-sized communities like Fostoria was deployed from multiple aspects. Large, national chain stores are desired by many communities and these stores are presented with more location opportunities than they have money or time to invest in. Targeting specific large, national chains that the city of Fostoria feels would complement the current retail mix will be important to finding the “right” national chains to pursue. Regional retail chains and franchises are typically located in metropolitan areas within a particular market area. Regional chains and franchises have local roots, local investors that understand the dynamics of a market region and are looking for compelling data to drive their expansion further into a regional market area.

Finally, cultivating entrepreneurs is an approach worthy of pursuit as many aspects of successful economic development include “growing your own.” Retail attraction from outside the immediate market area needs to be balanced with opportunities to capture and support entrepreneurs who are already invested in the community, likely being the most vested in the success of a community. The result of the retail study was a big success with the St. Wendelin site being cleared and sold for future retail use that the community needs as illustrated by the photo above.

Economic development plans provide a guidepost for communities to drive the creation of high-wage jobs and capital investments.

Contact Dave Robinson at [email protected] if you need assistance with an economic development strategic plan.