Foreign Direct Investment (FDI) should continue to be good business for corporate site location projects in 2024.

FDI is investments made by foreign companies or individuals in the United States. FDI or direct investment is a category of cross-border investment associated with a resident in one economy having control or a significant degree of influence on the management of an enterprise resident in another economy. Ownership or control of 10 percent or more of the voting securities of an entity in another economy is the threshold for separating direct investment from other types of investment. A foreign affiliate is a foreign business enterprise that is at least 10 percent owned by a single U.S. person or entity.

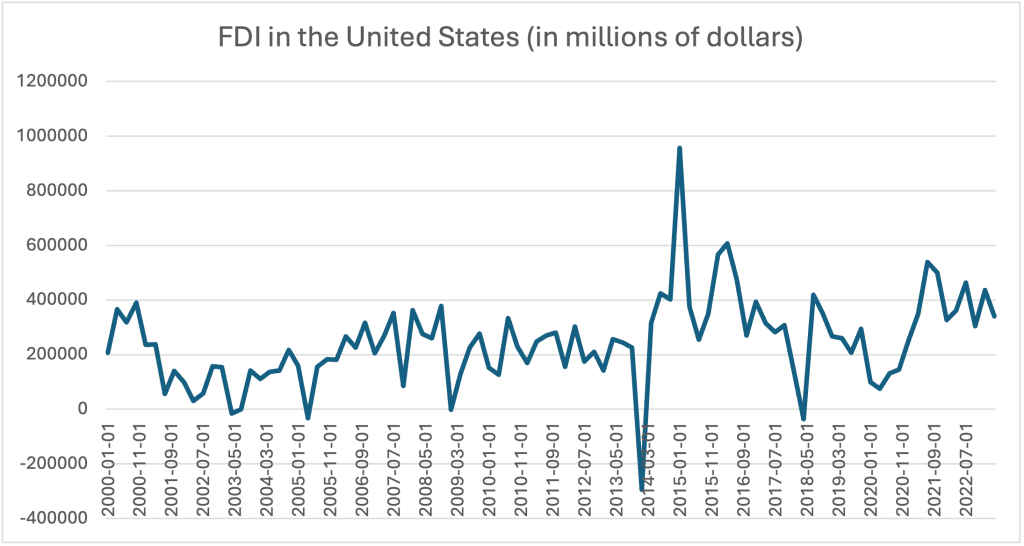

According to the United Nations’ statistics on FDI, the United States was the world’s largest recipient of foreign investment from 1985–2016. However, the U.S. share of global FDI declined from 40 percent in 1999 to 24 percent in 2016. More recent data from July 2023 reports from the U.S. Bureau of Economic Analysis (BEA) reveals a significant increase in FDI in the United States. FDI grew by $216.8 billion, reaching $5.25 trillion at year-end 2022, compared to $5.04 trillion at the end of 2021.

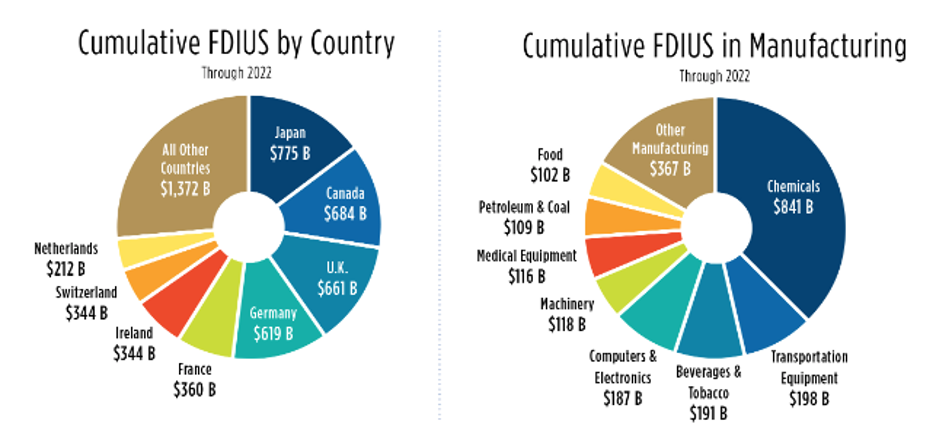

Where FDI is coming from to the United States is a critical issue to understand. Five countries accounted for more than half of the total foreign direct investment in the United States position at the end of 2022. Japan remained the top investing country with a position of $712.0 billion, followed by the United Kingdom ($663.4 billion), the Netherlands ($617.1 billion), Canada ($589.3 billion), and Germany ($431.4 billion).

By country of the ultimate beneficial owner (UBO), the entity at the top of the global ownership chain, Japan ($775.2 billion) remained the top investing country in terms of position at the end of 2022. Canada ($683.8 billion) was second, and the United Kingdom ($660.6 billion) was the third-largest investing country. On the UBO basis, investment from the Netherlands and Luxembourg was much lower than by the country of foreign parents, indicating that much of the investment from foreign parents in these countries was owned by investors in other countries. The increase reflected a $142.2 billion increase in the position from Europe, with the largest increases from the United Kingdom and Germany. By industry, affiliates in manufacturing and wholesale trade accounted for most of the increase. 200 international companies in the US provide 8 M jobs and FDI constitutes 23% of the U.S. manufacturing jobs. FDI employment grew by 11% from 2016 to 2021 in the United States – outpacing overall private-sector employment growth at 2%.

Business retention matters with FDI as many of these projects will be centered on existing global companies with U.S. locations. Greenfield investment expenditures—expenditures to either establish a new U.S. business or to expand an existing foreign-owned U.S. business—were $8.1 billion in 2022. By industry, greenfield expenditures were largest in manufacturing, totaling $5.3 billion, led by computer and electronic products ($1.8 billion). By region of UBO, Asia and Pacific ($3.4 billion) and Europe ($2.9 billion) had the largest expenditures. By state, California received the highest level of greenfield investment ($1.5 billion). In 2022, total planned employment, which includes the current employment of acquired enterprises, the planned employment of newly established business enterprises when fully operational, and the planned employment associated with expansions, was 185,600. Manufacturing accounted for the largest number of employees followed by professional, scientific, and technical services.

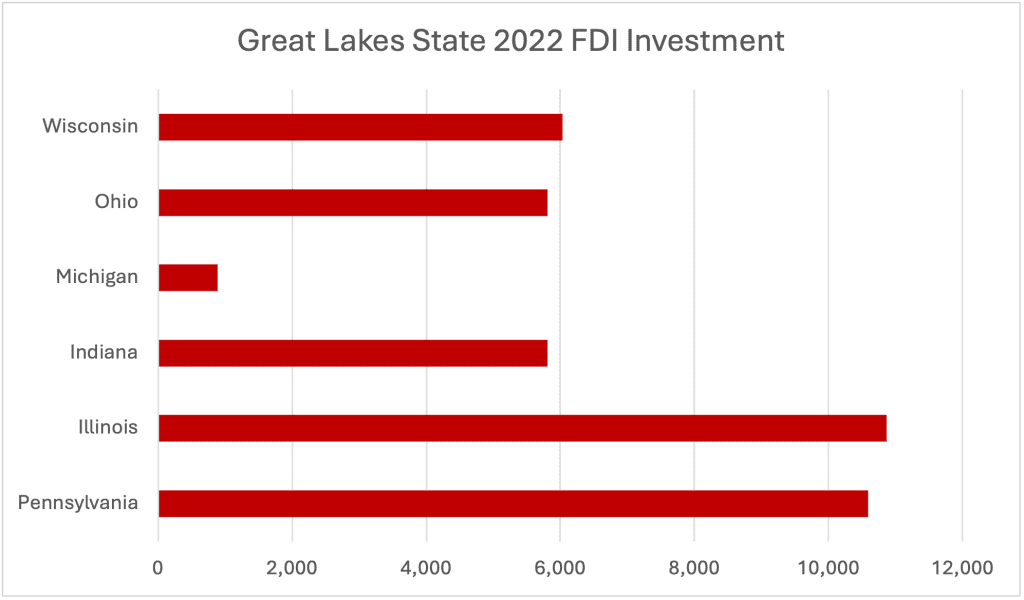

As a global manufacturing center, The Great Lakes states remain a prime location for global companies considering a U.S. location.

FDI will remain a growth prospect for 2024 corporate site location projects as the expansion of existing foreign-owned manufacturing companies are the prime target for economic growth.