A consensus among economic leaders is building that the United States is entering a sustained period of manufacturing growth known as a “Supercycle.” The Corporate Finance Institute defines a Supercycle as a period of strong economic growth, leading to sustained demand for commodities, and Fortune magazine defines a Supercycle as “a sustained spell of abnormally strong demand that producers struggle to match, sparking a rally in prices that can last years or in some cases a decade or more.”

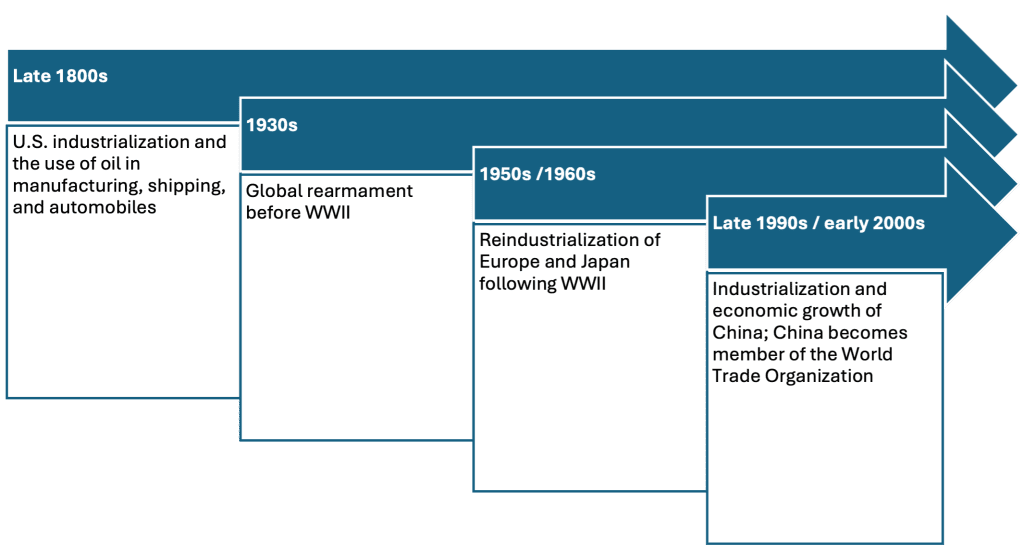

Four U.S. Manufacturing Supercycles

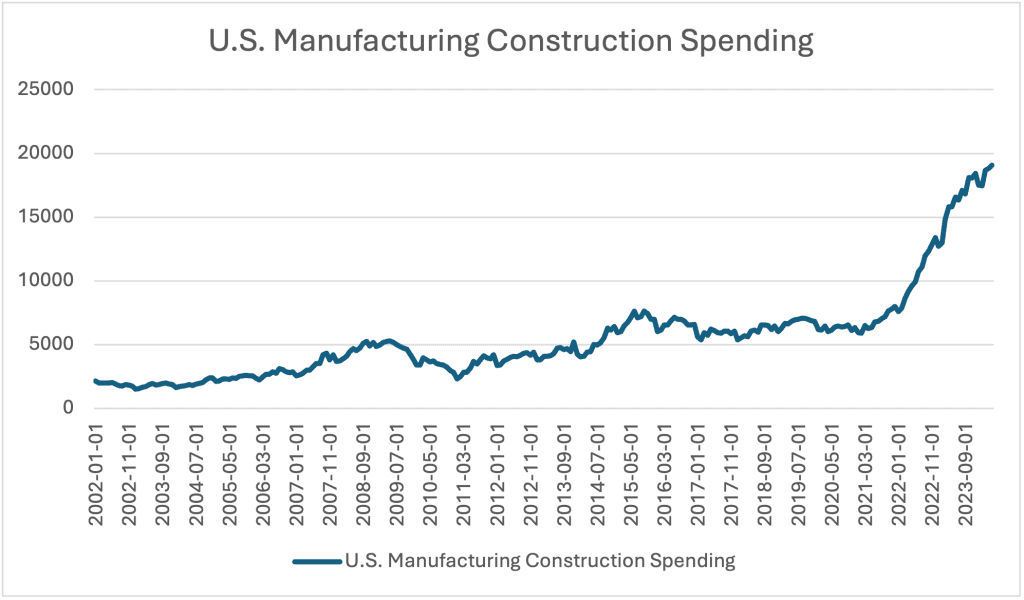

As outlined above, Orient Talent identified four manufacturing Supercycles in the past 150 years, corresponding with periods of rapid industrialization in the global economy. Orient Talent further reports that construction spending by U.S. manufacturers more than doubled over the past year. The amount of money spent on manufacturing construction reached $196.1 billion in July 2023, more than triple the rate in 2010.

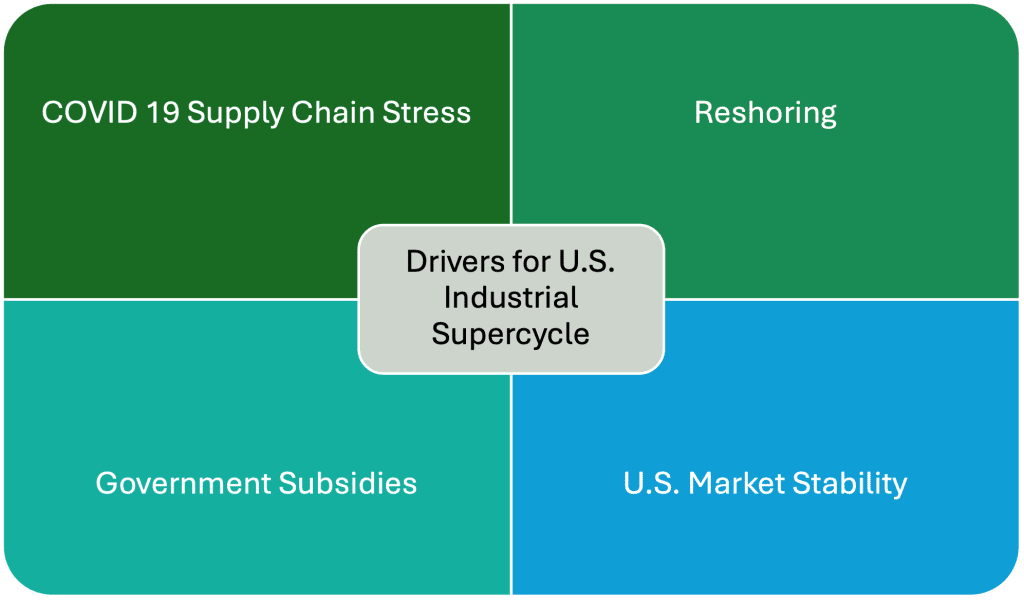

Lots of reasons exist for the coming U.S. industrial Supercycle with a few listed below.

-

- COVID 19 and Supply Chain Crisis. The COVID-19 pandemic exposed the vulnerabilities of global supply chains, leading to significant disruptions in manufacturing and distribution. This highlighted the need for countries, particularly the U.S., to reduce dependency on overseas manufacturing, prompting a shift toward reshoring and nearshoring.

- Reshoring and Nearshoring Trends: A significant number of U.S. manufacturing executives are moving production back to domestic or closer geographic locations. Reshoring brings manufacturing jobs back to the U.S., while nearshoring often involves relocating production to nearby countries like Mexico, which offers a balance of cost savings and control over production processes.

- Legislative Support and Economic Impact: U.S. legislative measures such as the Infrastructure Investment and Jobs Act, Inflation Reduction Act, and the CHIPS Act have been instrumental in supporting the resurgence of domestic manufacturing. These laws aim to tackle supply chain issues and stimulate domestic production, which has led to a doubling of manufacturing construction spending and growth in sectors like electronics and semiconductors.

- U.S. Market Stability. Despite an unpredictable Presidential election and a divided electorate, the United States remains the most stable economic market in the nation among the advanced economies. The war in Ukraine has destabilized Europe’s energy sources and created political and economic instability. Domestic political opposition to China in the United States from both political parties is shifting public policy strategies to treat China as an economic enemy jeopardizing the access to this market as the manufacturing outsource center for the United States.

Whatever the reason, the United States is primed for sustained manufacturing investment over the coming years.