Local and state governments facing potential economic challenges that could slow revenue collections for the first time in over a decade are likely to search for the best tax policy that can retain and attract the industry that is their focus. 2023 will be a year when state policymakers not just focus on economic development incentives but search for a tax policy that is designed to retain and recruit companies in targeted industries.

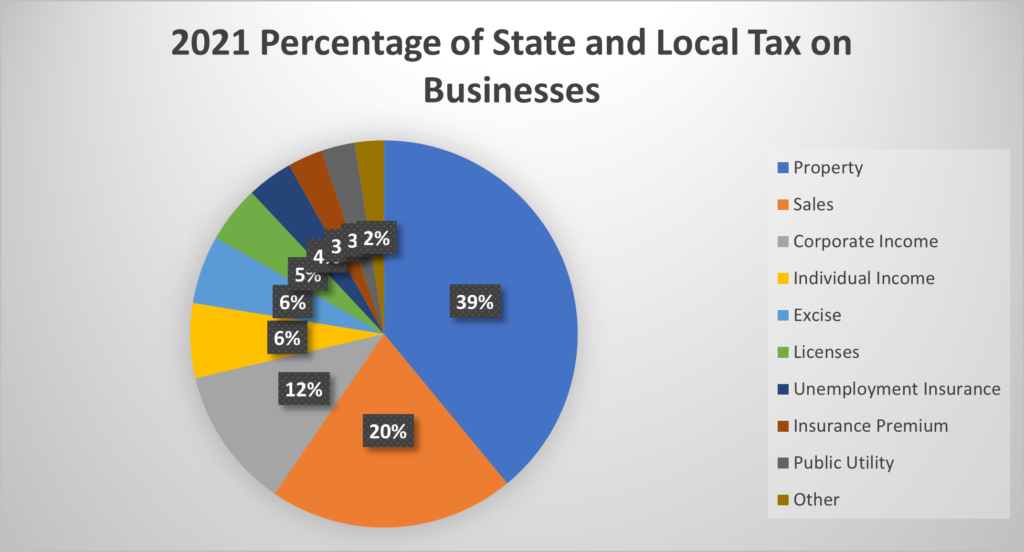

State and local governments apply taxes to local businesses. Business taxes include property taxes paid by businesses; sales and excise taxes on intermediate inputs and capital expenditures purchased by businesses; business entity taxes, such as the corporate income tax, gross receipts tax, franchise tax, and license taxes on businesses and corporations; the share of individual income taxes paid by owners of noncorporate businesses (passthrough entities); unemployment insurance taxes, and all other state and local taxes that are the statutory liability of business taxpayers.

According to the 2021 Council on State Taxation (COST) annual survey, businesses paid $951.4 B in state and local taxes in FY21, which was 43.6% of all tax revenue at the state and local levels. Businesses paid $493.7 B in state taxes in FY21, which was 17.0% higher than the prior fiscal year, and $457.6 B in local taxes, which was 10.2% higher, for a combined year-over-year growth rate of 13.6% over FY20 according to COST.

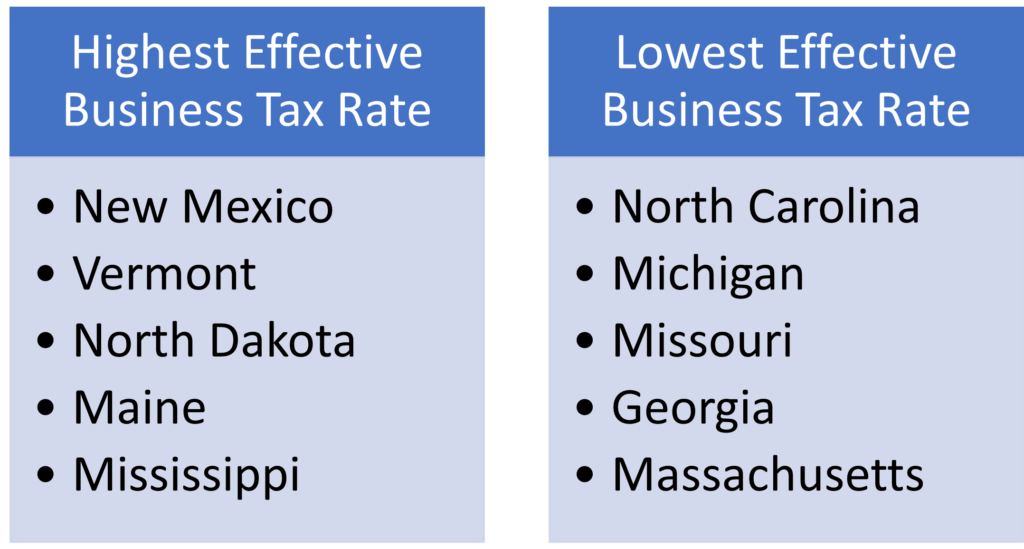

Not all local and state governments tax businesses in the same way or for the same amount. Generally, the higher the taxes are on business the less attractive that region is to companies seeking a corporate site location. Economic development incentives can help address these high-cost markets but are generally not nearly on par with the taxes the company pays.

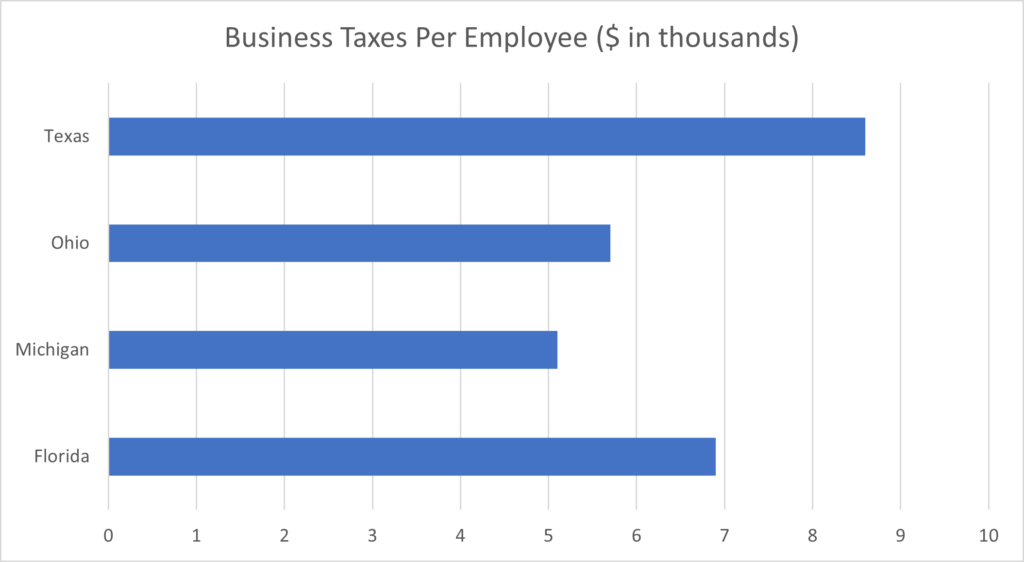

The types of taxes local and state governments apply to businesses and what taxes are exempt on businesses impacts the effective tax rate on companies seeking a corporate site location. First, many states promote their pro-business environment based upon a lack of an income tax but that may not result in lower tax costs for their companies.

As the chart above illustrates, Texas and Florida, who operate without state and local income taxes tax their businesses more on an employee basis than the industrial states of Ohio and Michigan which both operate with an income tax.

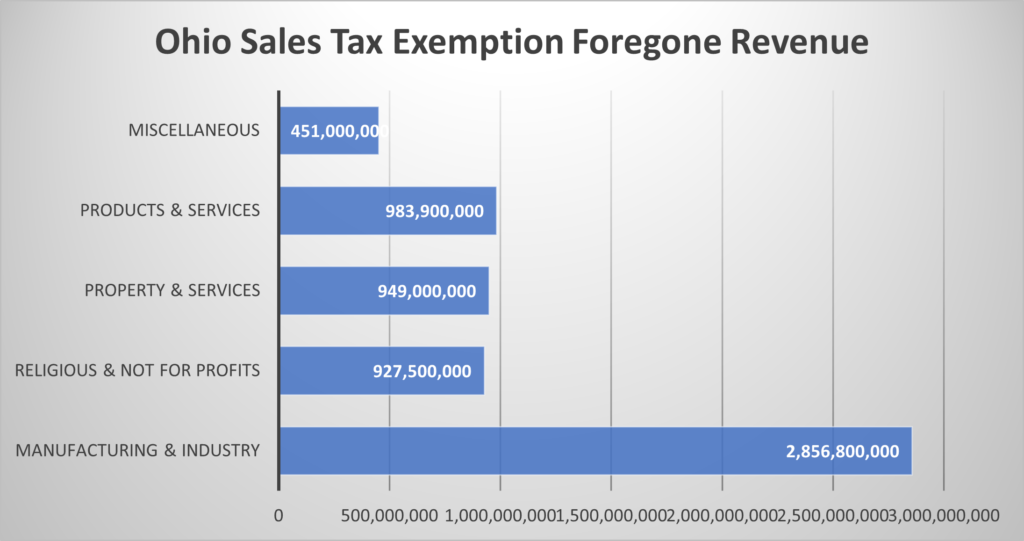

States also use exemptions from taxes as a tool to support the retention and attraction of targeted industries. Look at Ohio’s effort to continue their hundred year-long success rates in the manufacturing sector.

As the chart above illustrates, Ohio offers billions in sales tax exemptions to the manufacturing sector and other businesses. This impact is important as the sales tax is the state of Ohio’s largest source of revenue and county governments, and social service agencies are able to increase the local sales tax as well. Much of which does not impact investments in Ohio’s manufacturing industry.

How and how much local and state government’s tax business has an impact on a company’s corporate site location decisions and shaping local and state tax policy is critical to retaining and attracting companies to a market.