Housing is joining workforce development to become a major corporate site location trend in 2023. Companies looking to grow or locate in a region can no longer just assume that a community has housing available that fits the needs of their workforce. Growing regions like Central Ohio are developing 2.5 jobs for every 1 residential permit creating a housing shortage. Regions not growing are failing to develop substantial residential growth. Rural regions are losing population at an alarming rate and desperately need new residential products to retain existing employers and to keep their young people. No matter where you are in the United States, the availability of attainable housing that young and old alike can afford is needed.

Record-high job openings, turnover, low unemployment, and local governments opposed to additional housing development have sent companies scrambling to find creative attraction and retention strategies, and housing has become one of them. After the Great Recession, new home construction dropped like a stone.[i] Fewer new homes were built in the 10 years that ended in 2018 than in any decade since the 1960s.[ii] By 2019, a good estimate of the shortage of housing units for sale or rent was 3.8 million.[iii] The pandemic-induced materials and labor shortage exacerbated the trend, however, as evidenced by the surge in rents and home prices in 2021.[iv] A Fannie Mae study found that the most housing-cost-burdened households are not just in coastal metros with high housing costs.[v] Some of the nation’s most significant shares of housing-cost-burdened households are in less expensive metros such as Fresno, Charlotte, and Las Vegas, and, even many smaller metro areas, such as El Paso or McAllen, TX, do not have a housing supply that is affordable for large swathes of their populations.[vi]

Booming regions such as Columbus, Ohio illustrate a crisis not driven by high-wage job creation but the lack of available housing. Supported by the global corporate site location win of gaining a $20 B Intel “fab” manufacturing plant, Columbus is expected to add over 50,000 jobs in the coming decade. The simple fact is Columbus has not been keeping up with their growth from a housing standpoint for decades. Housing experts estimate that one new housing permit is needed for every new, net job created. Thus, housing needs to be developed on a one-to-one ratio. According to a recent VSI study, the Columbus region has been developing 95 housing permits for every 100 net, new jobs created. More importantly, all income levels will need housing in the Central Ohio marketplace. From the rich to the poor, the availability of housing is a critical corporate site location factor.

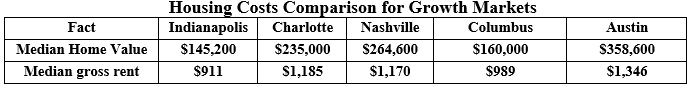

What Columbus and other growth markets don’t want is the rising housing costs of fast-growing markets such as Austin, Nashville, Charlotte, and elsewhere. As the table above illustrates, these booming urban markets are reaching the point of cost of housing impacting their competitiveness for corporate site location projects. Companies won’t locate in a region where their workers cannot afford housing.

Rural communities face the opposite challenge of booming urban markets. The depopulation of rural counties across the United States and the world, not only jeopardize the attraction of new companies to rural markets in search of workers but also does not attract much if any new housing development to these regions. Without new residential investment, the effort to retain rural residents is nearly impossible.

Companies and communities working to address the housing crisis need a four-step approach: define the housing challenge; build local Public-Private-Private-Partnerships; capitalize on economic development incentives to spur residential growth; and adopt new state government policies to support residential development in urban, suburban, and rural markets.

Addressing a housing challenge involves first defining the housing challenge. The first step for a company or community addressing a housing challenge is to conduct a housing study that defines the good, the bad, and the ugly of the region’s residential prospects. Phase I of a housing study focuses on economic and demographic trends that research Gross Domestic Product, Personal Income, and other economic measures of growth over a period of time as well as demographic trends such as population, poverty, educational attainment, and other demographic measures of a community that impact the resident’s ability to buy or rent housing. Next, housing trends are researched to review residential construction activity, price trends, days on the market, and other housing economics in the region. Phase II of a housing study involves the development of a housing forecast and market analysis. The housing forecast will include an analysis of existing housing inventory, types of units needed, and demand in the market. It may also include a future housing buyers survey that examines the types of housing/floorplans, price bands, desirable areas to live in, and employment projections over the next 10 years. Finally, the housing forecast will have a report on the housing landscape, trends, future buyers’ analysis, pricing, and target areas for future residential investments.

Communities struggling to attract new residential development may well undertake a process to recruit residential developers to their community and, potentially, to a specific site in their community. These communities will likely identify and secure land prime for residential development, create a property tax abatement or other economic development incentive attached to this site to support residential development, develop and issue a Request for Proposals (RFP) to national residential developers, interview, recommend, and negotiate agreements with the residential developer(s), start residential housing projects

Examples of these local residential Public-Private-Partnerships are one step that can help address local housing needs impacting corporate site location projects. In northwest Ohio, the city of Bowling Green has been part of significant economic development activity within the region which is expected to bring thousands of new jobs over the next five years. Under the leadership of the city of Bowling Green and its economic development agency (BGED), the city went directly to regional residential developers with an opportunity to construct residential housing on BGED-controlled property. BGED was interested in developing 9 parcels within the city limits, representing approximately 247 total acres of vacant agricultural land. Through this process, BGED aims to engage a development partner to work collaboratively to address the diverse residential housing needs in the City of Bowling Green, considering a mix of proposed residential uses, including single-family and townhome options.

State governments as implemented often through their local governments can create a rage of economic development incentives designed to spur residential development. Ohio offers a range of tax incentives and public finance tools to develop residential projects. These tools range from tax abatements to tax credits to sales tax exemptions to grants and loans to infrastructure funding.

Community Reinvestment Act Tax Abatements. Ohio law authorizes local governments to provide property tax abatements on new investments up to 100% through the Community Reinvestment Area (CRA) program that does not require local school board approval for districts created before 1994.

Downtown Redevelopment Districts. Ohio’s Downtown Redevelopment District Program permits the capture of up to 70% of the future property tax growth around 10 acres of a historic structure for public infrastructure, historic groups, building renovations, and innovation districts.

New Community Authority (NCA). A new community authority or “NCA” is a special unit of government that permit landowners to create a special assessment known as a Community Development Charge to finance and construct community facilities that include any kind of public improvement within the district and include facilities that are used in furtherance of community activities such as cultural, educational, governmental, recreational, residential, industrial, commercial, distribution, and research activities.

Ohio Historic Preservation Tax Credits. The Ohio Department of Development awards twice annually Ohio Historic Tax Credits for designated historic properties (structures 50 years or older) that can provide direct building funding for historically consistent remodeling costs. State Historic Preservation Tax Credits are awarded twice annually and provide a state tax credit of up to 25% of qualified rehabilitation expenditures incurred during a rehabilitation project, up to $5 million.

Ohio New Markets Tax Credit Program. The Ohio New Markets Tax Credit Program awards tax credit allocation authority to Community Development Entities (CDE) serving Ohio that serves as an intermediary between investors and projects. Ohio offers $10 million in tax credit allocation authority is available to CDEs each year.

Ohio Opportunity Zone Tax Credit. The Ohio Opportunity Zone Tax Credit Program provides an incentive for Taxpayers to invest in projects in economically distressed areas known as “Ohio Opportunity Zones”. If an Ohio taxpayer invests cash in the Ohio Qualified Opportunity Fund, which in turn must invest that money in an Ohio Qualified Opportunity Zone property in Ohio, the Taxpayer is eligible for a non-refundable tax credit equal to 10% of the number of its funds invested.

Ohio Transformational Mixed-Use District (TMUD). $100 M in premium insurance tax credits is available for large-scale mixed-use developments in major and non-major cities over the next four years awarded by the Ohio Department of Development.

Ohio Sales Tax Exemption. Ohio port authorities are permitted to offer a sales tax exemption on construction materials used for economic development projects through a sales-lease back agreement that typically lasts for five years.

Tax Increment Financing. Ohio’s Tax Increment Financing (TIF) Program funds public infrastructure through the capture of future property tax growth of a defined district or site that may include residential development. An Ohio local political jurisdiction may exempt from real property taxes the value of private improvements up to 75 percent for a term of up to 10 years for a General Purpose TIF. Local governmental bodies seeking to offer greater amounts of assistance under the TIF must first obtain the concurrence of the affected local board(s) of education.

The larger solution to housing policy likely resides in Statehouses across America. It is part money but part regulatory changes. Addressing the housing crisis requires state governments to launch a comprehensive policy approach focused on all housing options in urban and rural markets.

Housing Mezzanine Fund. Rising interest rates are jeopardizing major residential projects. A state housing mezzanine fund can be created from American Rescue Plan Act (ARPA) funds to match funds with lending institutions to provide mezzanine financing for residential development projects to meet the funding gap created by rising interest rates.

Regulatory Reform. A predictable land use and property tax assessment process is critical for the development of residential projects in urban and rural markets.

- Rural County Zoning. Small townships lack the ability to operate local land use programs and zoning should be in the hands of county government to ensure professional staff is in place to administer state zoning laws.

- Referendum Reform. States may only require 8% of the registered voters for a referendum on a local government ordinance or resolution to be placed on the ballot and this threshold should be substantially increased to 35% as required for the petition for a local liquor option.

- Property Tax Assessment. Again, states like Ohio operate with a complicated property tax assessment process that can impede residential institutions from predicting property tax costs. States can limit property tax appeals to only property owners, not disclose the value of the land purchase, and exempt from property tax the value of unimproved land subdivided for residential development more than the fair market value of the property for up to eight years or until construction begins or the land is sold.

Tax Abatement Reform. States should permit local governments to provide residential real property tax abatements without interference from local school districts or other taxing authorities. School districts are often the biggest opponents of residential growth even though they are in the business of serving local residents.

Rural Housing Loan Program. States should consider creating a rural housing loan program to support developers’ efforts to fund rural housing developments in rural counties.

Housing Infrastructure Fund. The availability of residential public infrastructure is essential in challenging financial markets. States can create a housing infrastructure fund from ARPA funds to award matching grants for residential public infrastructure and permit the local creation of Infrastructure Improvement Districts modeled after Transportation Improvement Districts for regional residential infrastructure efforts.

State Housing Tax Credits. The federal LIHTC program provides millions of affordable housing units. Over twenty states also created a workforce housing tax credit to provide support for LIHTC investors for their projects in the state.

The availability of housing in a market is going to be an important measure for companies considering a corporate site location project. Communities and states need to move aggressively in 2023 to address the rising housing crisis in the United States to continue to capture future job growth.

Please contact Dave Robinson, Principal of the Montrose Group, at [email protected] if you need assistance with any housing or other corporate site location matter.