Ohio offers a range of tax incentives and public finance tools to develop residential projects. These tools range from tax abatements to tax credits to sales tax exemptions to grants and loans to infrastructure funding.

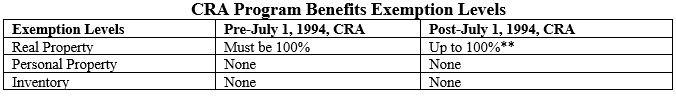

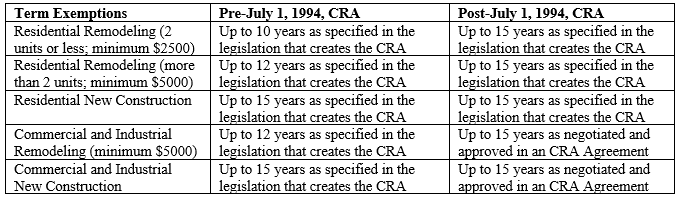

Community Reinvestment Act Tax Abatements. Ohio law authorizes local governments to provide property tax abatements on new investments up to 100% through the Community Reinvestment Area (CRA) program that does not require local school board approval for districts created before 1994. The Ohio CRA program is an economic development tool administered by municipal and county governments that provides real property tax exemptions for property owners who renovate existing or construct new buildings. CRAs are areas of land in which property owners can receive tax incentives for investing in real property improvements. The program is delineated into two distinct categories, those created prior to July 1994 (“pre-1994”) and those created after the law changes went into effect after July 1994. The Ohio CRA Program is a direct incentive tax exemption program benefiting property owners who renovate existing or construct new buildings. This program permits municipalities or counties to designate areas where investment has been discouraged as a CRA to encourage the revitalization of the existing housing stock and the development of new structures. Local municipalities or counties can determine the type of development to be supported by the CRA Program by specifying the eligibility of residential, commercial and/or industrial projects.

The exemption percentage and term for commercial and industrial projects are to be negotiated on a project-specific basis. If the proposed exemption exceeds 50%, local school district consent is required unless the legislative authority determines, for each year of the proposed exemption, that at least 50% of the amount of the taxes estimated that would have been charged on the improvements if the exemption had not taken place will be made up by other taxes or payments available to the school district. Upon notice of a project that does not meet this standard, the board of education may approve the project even though the new revenues do not equal at least 50% of the projected taxes prior to the exemption.

Downtown Redevelopment Districts. Ohio’s Downtown Redevelopment District Program permits the capture of up to 70% of the future property tax growth around 10 acres of a historic structure for public infrastructure, historic groups, building renovations, and innovation districts. Ohio’s Downtown Redevelopment District (DRD) program is a critical tool for municipalities in Ohio to use for redeveloping important historic structures. Downtown Redevelopment Districts work like Tax Increment Financing in that they capture new growth in property taxes in a defined 10-acre district continuous to a certified historic structure. Unlike a TIF that is generally restricted to public infrastructure improvements, a DRD can be used to redevelop the historic building, encourage economic development in commercial, mixed-use, and residential areas, build public infrastructure, or fund local economic development groups associated with the projects.

New Community Authority (NCA). A new community authority or “NCA” is a special unit of government authorized under Chapter 349 of the Ohio Revised Code. NCAs permit landowners to create a special assessment known as a Community Development Charge to finance and construct community facilities that include any kind of public improvement within the district and include facilities that are used in furtherance of community activities such as cultural, educational, governmental, recreational, residential, industrial, commercial, distribution and research activities.

Ohio Historic Preservation Tax Credits. The Ohio Department of Development awards twice annually Ohio Historic Tax Credits for designated historic properties (structures 50 years or older) that can provide direct building funding for historically consistent remodeling costs. State Historic Preservation Tax Credits are awarded twice annually. The Ohio Historic Preservation Tax Credit Program provides a state tax credit up to 25% of qualified rehabilitation expenditures incurred during a rehabilitation project, up to $5 million.

Ohio New Markets Tax Credit Program. The Ohio New Markets Tax Credit program provides an incentive for investors to fund businesses in low-income communities in federal government-certified New Markets Tax Credit census tracts. The Ohio New Markets Tax Credit Program awards tax credit allocation authority to Community Development Entities (CDE) serving Ohio that serves as an intermediary between investors and projects.[i] The investor provides cash to a CDE in exchange for the tax credit (39 percent of their investment claimed over seven years). The CDE uses the cash for projects in low-income communities.[ii] Ohio offers $10 million in tax credit allocation authority is available to CDEs each year.[iii]

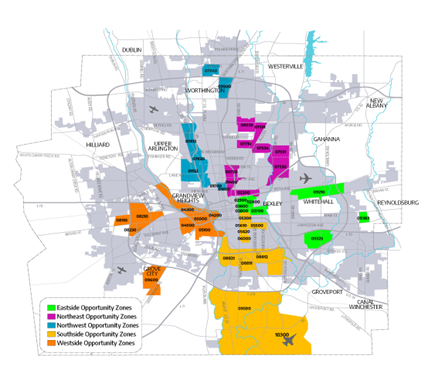

Ohio Opportunity Zone Tax Credit. The Ohio Opportunity Zone Tax Credit Program provides an incentive for Taxpayers to invest in projects in economically distressed areas known as “Ohio Opportunity Zones”. The Ohio Opportunity Zone Tax Credit is applied to the individual income tax, as outlined in the Ohio Revised Code Section 5747.02, and the tax credit may be claimed for the Taxpayer’s qualifying taxable year or the next consecutive taxable year.[i] For the 2022-2023 biennium, a total of $50 million in tax credit allocation is available, and taxpayers that have invested in an Ohio QOF must apply directly to the Ohio Department of Development (“Development”) for the tax credit during the established application period, occurring annually in January2.[ii]

Ohio Transformational Mixed-Use District (TMUD). $100 M in premium insurance tax credits is available for large-scale mixed-use developments in major and non-major cities over the next four years awarded by the Ohio Department of Development. A project within a major city (100,000 or more in population) is eligible for a TMUD tax credit if it exceeds $50 million, includes the renovation, rehabilitation, or construction of at least one new or previously vacant building; is 15 stories in height, or is at least 350,000 sq. ft., or is a project which creates $4 million in annual payroll. A project not within a major city (100,000 or more in population) is eligible for TMUD tax credits if the project includes at least one new or previously vacant building that is two or more stories in height, or is at least 75,000 sq. ft.

Ohio Sales Tax Exemption. Ohio port authorities are permitted to offer a sales tax exemption on construction materials used for economic development projects. An Ohio port authority such as the Columbus-Franklin County Finance Authority issues taxable bonds to finance the project, they hold the title to the building and enters into a long-term lease with the client (typically five years), the bonds may be purchased by the client’s bank or a related entity of the client itself, the port authority could place the bonds in the capital markets, at the end of the lease term, the building’s title would be transferred to the client for a nominal amount, and the client would be viewed as the building’s owner for federal tax purposes and therefore would be able to take depreciation on the building.

Tax Increment Financing. Ohio’s Tax Increment Financing (TIF) Program funds public infrastructure through the capture of future property tax growth of a defined district or site. An Ohio local political jurisdiction may exempt from real property taxes the value of private improvements up to 75 percent for a term of up to 10 years for a General Purpose TIF. Local governmental bodies seeking to offer greater amounts of assistance under the TIF must first obtain the concurrence of the affected local board(s) of education. With the concurrence of its school board(s), a local political jurisdiction may exempt the value of improvements up to 100 percent for a term of up to 30 years. Funding for a General Purpose TIF can be used for public infrastructure improvements.

Special Improvement Districts. Ohio’s Special Improvement Districts (SID) permit property owners in a defined area through a majority vote to create a special assessment to fund area public infrastructure improvements and provide services. A SID is established when owners representing 60% of the front footage or 75% of the land area of the district sign a formal petition to establish it. Services must be for the public good and may include maintenance, physical improvements, cleaning, and additional safety among a variety of activities. The services are chosen by the property owners themselves, through a Board of Directors, and cannot replace city services.

Ohio Prohibition Against Local Government Rent Control. In response to a ballot initiative proposed in the City of Columbus, the Ohio General Assembly recently enacted state legislation to provide a statewide prohibition against local rent control ordinances and regulations. The General Assembly amended Ohio’s landlord and tenants law applying to all local government political subdivisions—townships, cities and counties to prohibit rent control or rent stabilization ordinances and regulations adopted by political subdivisions unless the property is owned by the political subdivision, or such regulating is related to voluntary agreements or incentives to increase or maintain the supply or improve the quality of available residential premises to promote affordable housing provided under LIHTC or similar programs or where, in return for granting some type of tax abatement or credit, the city requires, and the owner agrees, to limit rents. The new law defines “Rent control” as “requiring below-market rents for residential premises or controlling rental rates for residential premises in any manner;” “rent stabilization” is defined as “allowing rent increases for residential premises of a fixed amount or on a fixed schedule as set by a political subdivision.” Ohio offers a wide range of economic development incentive programs designed to encourage the development of housing throughout the Buckeye State.