Recently, bipartisan federal legislation was introduced to strengthen and improve Opportunity Zone policy in the United States. Opportunity Zones are a federal government program that provides capital gains tax relief for taxpayers who invest in real estate or qualified companies in one of more than 8,700 certified sites in all fifty states and U.S. territories. Essentially, it is an economic development tool that allows people to invest in distressed areas in the United States. The bill, dubbed the “Opportunity Zones Transparency, Extension, and Improvement Act,” is supported by Senators Cory Booker (D-NJ), Tim Scott (R-SC), Mark Warner (D-VA), Chris Van Hollen (D-MD), Todd Young (R-IN), Representatives Ron Kind (D-WI-03), Mike Kelly (R-PA-16), Terri Sewell (D-AL-07), Dan Kildee (D-MI-05), and Jackie Walorski (R-IN-02). The Opportunity Zones Transparency, Extension, and Improvement Act is a comprehensive piece of legislation that would accomplish many things including:

- Modifying the qualifications for Opportunity Zone designated tracts to remove tracts that exceed 130% of the national median family income and have lower than a 30% rate of poverty;

- Increasing transparency and establishing reporting requirements thereby allowing the federal government to keep track of the number of people employed through Opportunity Zone investments;

- Expanding the funding model for impact-oriented Opportunity Zone funds to include an opportunity for Qualified Opportunity Zones (QOF) to invest in other QOFs. This model would help smaller and more regionally focused funds raise capital and overcome scale challenges with institutional investors; and

- Establishing a fund to support state and community efforts to attract investment into high-impact projects in high-need industries such as healthcare, social services, food access, education, and broadband.

Strengthening initiatives to further aid economically disadvantaged communities is important for future prosperity. The average poverty rate of qualified opportunity zone residents is 26.4%, nearly double the national average. They cover 54% of the country’s pockets of concentrated persistent poverty, meaning census tracts in which at least 40% of the population has lived in poverty since at least 1980. More adults in qualified opportunity zones lack a high school diploma than have a four-year college degree. Opportunity Zones are beneficial for these areas, but they are also incredibly beneficial for developers. In 2019, Ohio taxpayers saved approximately $240 million by reinvesting otherwise taxable capital gains into 85 new business ventures located in Ohio Opportunity Zones.[1] Developers in other states have been taking advantage as well. Philadelphia investors are leveraging Opportunity Zone incentives for projects with social impact. Sterling Wilson and his partners have taken on the Jasper House Project with plans to build 139 apartments, artist studios, and 6,500 square feet of space with affordable leases.

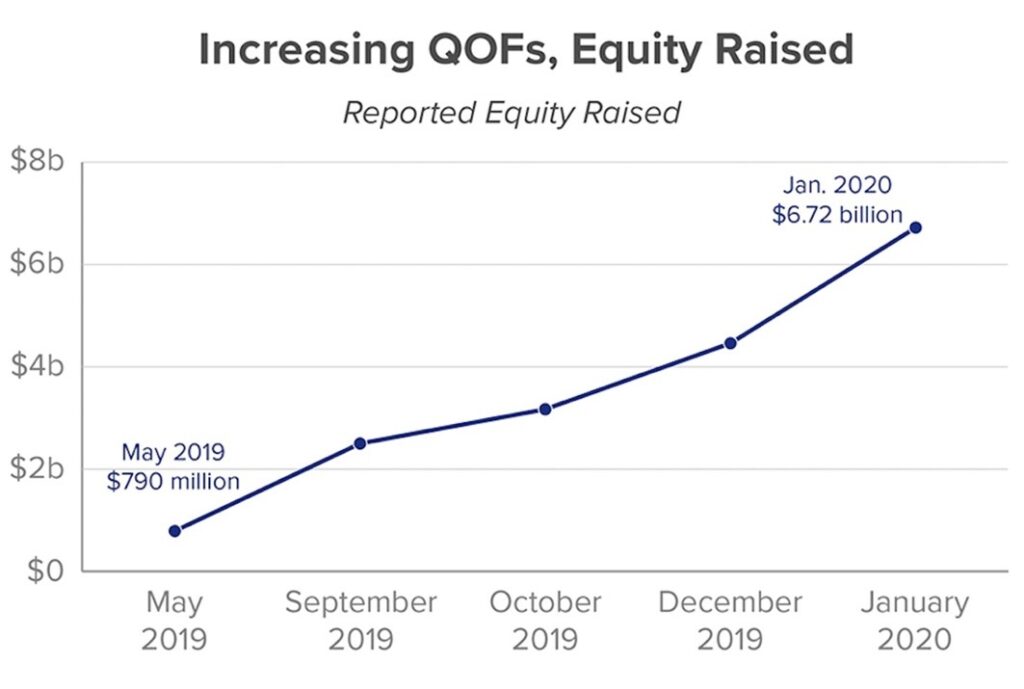

In Colorado, theVeterans Victory Opportunity Fund is developing the Victory Housing and Small Business Center, a $67 million project financed with $2 million in Opportunity Zone equity. Once completed, the site will offer 240 units of green and accessible multifamily housing, 15 office spaces, and other coworking and networking spaces. Nationally, an estimated $6.72 billion has been invested in opportunity zone funds.

For more information on the Opportunity Zones Transparency, Extension, and Improvement Act, see the Section by Section Summary, One-pager, and Bill Text.