Ohio, like many other Midwest industrial states, benefits from a wide range of local and state economic development programs. The recently passed state operating budget contained updates and enhancements to many of the Ohio economic development programs worthy of note.

Ohio Jobs Creation Tax Credit Program. The state of Ohio operating budget allows any business that receives the Job Creation Tax Credit (JCTC) to include work-from-home employees in its annual reporting of employment and payroll, thus allowing those employees’ payroll to count towards computing and verifying the credit, beginning with reports filed for 2020. Current law only allows JCTC recipients whose applications were approved after September 29, 2017, to include work-from-home employees. The JCTC is a refundable and performance-based tax credit calculated as a percent of created payroll and applied toward the company’s commercial activity tax liability. Should the amount of the credit exceed the company’s commercial activity tax liability for any given year, the difference is refunded. Companies creating at least 10 jobs (within three years) with a minimum annual payroll of $660,000 and that pay at least 150 percent of the federal minimum wage are eligible for the credit; however, they must apply for the credit before committing to a project. The Ohio Tax Credit Authority must approve applicants before hiring begins.

Ohio Jobs Retention Tax Credit Program. The state of Ohio operating budget requires the Tax Credit Authority and Director of Development, when recommending and approving job retention tax credit (JRTC) applications, to give priority to applications that meet one or more of the following criteria: (1) the applicant has not received a JRTC or job creation tax credit (JCTC) for the same location within the preceding five years, (2) the applicant is not currently receiving a JRTC or JCTC, (3) the applicant’s facility has been operating in Ohio for the preceding 10 years, (4) the project will involve more than routine maintenance, and (5) the applicant intends to use materials and equipment sourced from Ohio businesses in the project. The Ohio JRTC provides a non-refundable tax credit to companies that employee 500 FTEs or have $35M in payroll. If a business is engaged at the site primarily as a manufacturer, the business no longer has an employment or payroll threshold; it just has to make or cause to be made payments for the capital investment project at the site during a period of three consecutive calendar years in an amount that in the aggregate equals or exceeds the lesser of $50 million, or 5% of the net book value of all tangible property used at the site as of the last day of the three-year period in which capital investment payments are made. If a business is engaged at the site primarily in significant corporate administrative functions, the business must satisfy two requirements: be located in a Foreign Trade Zone, employ at least 500 full-time equivalent employees, or have an annual payroll of at least $35 million; and (ii) make or cause to be made payments of $25 million in the aggregate for the capital investment project at the site during a period of three consecutive calendar years.

Ohio Joint Economic Development District Program. The state of Ohio operating budget made the following changes to the procedure for creating certain joint economic development districts (JEDDs): 1) Modifies the notice and opt-out procedures for certain property that (a) is located within 1/2 mile of the JEDD or (b) receives water or sewer services under certain agreements from a municipality that is not part of the JEDD, and 2) Requires that the JEDD contract include certain information relating to the district’s public utility infrastructure, if the proposed JEDD would include any property in which any non-JEDD party would provide water or sewer services. JEDDs are a unit of government formed jointly by Ohio townships and municipalities for economic development purposes and they give townships the ability to collect an income tax that can be used for infrastructure and other governmental purposes.

Ohio Maritime Assistance Program. The state of Ohio operating budget provides $23 M in funding for the Ohio Maritime Assistance Program (MAP) to be used to issue grants to qualifying port authorities over FY 2022 and 2023. The Ohio MAP is a significant source of Ohio Department of Transportation funding dedicated exclusively to water-based freight infrastructure. This competitive grant program makes funding available to eligible Ohio port authorities on Lake Erie, the Ohio River, or a Lake Erie tributary. The MAP requires a 50% match. A wide variety of projects are eligible to receive funding under the Ohio MAP. Examples include the improvement or construction of maritime cargo facilities, improvements to shipping channels and the purchase of heavy equipment for cargo loading and unloading. In addition to capital expenses, the funding may be used for right-of-way acquisition, environmental remediation and the planning and engineering work required for maritime freight improvement projects. In the past, MAP awards required that projects result in the handling of new types of cargo or an increase in cargo volume.

Ohio New Community Authority Program. The state of Ohio operating budget specifies that a person controlling land pursuant to certain 99-year renewable leases qualifies as a developer eligible to form a new community authority (NCA), which may carry out development and management activities respecting such property and levy development charges to fund the NCA’s activities, provided that developer establishes the NCA on or before December 31, 2021. Continuing law qualifies developers that control property pursuant to a lease of at least a 75-year term. An NCA is a special unit of government created to encourage the orderly development of well planned, diversified and economically sound new communities and of encouraging the initiative and participation of private enterprise in such undertakings; and encouraging cooperation between the developer and the community authority to carry out a new community development program. Their prime benefit is they permit special assessments to be charged in a defined area to be used for development related expenses.

Ohio Rural Business Growth Fund. The state of Ohio operating budget increases the existing insurance premiums tax credit for investments in Rural Business Growth Funds by $45 M the amount of tax credits that may be awarded by the Department of Development as the current tax credit program has already exhausted its previous $45 M credit limit. Under continuing law, credits are claimed in four annual installments following a three-year holding period after the investment is certified as tax-credit eligible. The new law also modifies the eligibility criteria and investment criteria for the new credit allocation as follows: (1) decreases for businesses located in a border county, the percentage of the business’s employees who must reside in Ohio or, alternatively, the percentage of the business’s payroll that must be paid to Ohio residents in order for investments in that business to be credit eligible, (2) increases, by one year, the time over which the rural business growth fund must invest its contribution in a way that would qualify for the credit, (3) creates tiers of rural counties, based on population, where eligible investments must occur, and (4) adjusts the amount of credit-eligible contributions that may be invested in a single business. The Ohio Department of Development can begin accepting applications from growth funds to qualify for the new credit allocation beginning 30 days after the bill’s 90-day effective date.

Ohio Tax Increment Financing and Downtown Redevelopment District Programs. The state of Ohio operating budget modifies the law governing tax increment financing districts (TIF) and downtown redevelopment districts (DRD) to: (1) allow subdivisions to use TIF or DRD service payments for off-street parking facilities and (2) allow municipalities that create certain types of TIFs the discretion to designate the beginning date of the TIF exemption, rather than the exemption automatically beginning on the effective date of the designating ordinance. TIFs are the prime Ohio public finance tool used to capture future property tax growth generally used for public infrastructure. DRDs, operate similar to TIFs, but the future property tax growth of a defined 10-acre parcel around a certified historic structure can be used for public infrastructure and funding of historic building costs.

Ohio Transformational Mixed Use Development Program. The state of Ohio operating budget

modifies an existing insurance premium tax credit for capital contributions to the construction of a transformational mixed use development (TMUD) by: (1) extending the sunset date for certifying new TMUD projects by two years, to June 30, 2025; and (2) setting the maximum annual credit allotment for FY 2024 and FY 2025 at $100 M which is the same limit that applies under current law to FY 2020 to FY 2022, though no credits have been issued in FY 2020 or FY 2021. TMUD creates a nonrefundable credit of 10% of the development costs or 10% of an insurance company’s capital contribution and permits unclaimed credit amounts to be carried forward for up-to five years. A nonrefundable tax credit, compared to a refundable tax credit, can only be exercised by organization that pay taxes to the state of Ohio. Refundable tax credits are available whether the organization has a tax bill at the end of the year or not and really acts for practical purpose as a government grant. The bill allows insurance companies to apply directly for the credit or to purchase the right to claim the credit from a property owner. Thus, SB 39’s TMUD program creates an important tool for developers to access capital to make their projects a reality. Not all mixed-use developments are eligible for the tax credit benefits of the TMUD program. This legislation defines a TMUD as a project that meets the following criteria:

- A project within a major city (100,000 or more in population) that exceeds $50 million, includes the renovation, rehabilitation, or construction of at least one new or previously vacant building; is 15 stories in height; or is at least 350,000 sq. ft.; or is a project which creates $4 million in annual payroll.

- A project not within a major city (100,000 or more in population) the project includes at least one new or previously vacant building that is two or more stories in height; or is at least 75,000 sq. ft.

TMUD sets aside a cap of up-to $100 million per fiscal year, with no more than $40 million going to a single project and divides the overall $100 million between large city and small city projects, $80 million for large cities and $20 million for small cities. The first round of TMUD guidelines and applications are expected later this summer.

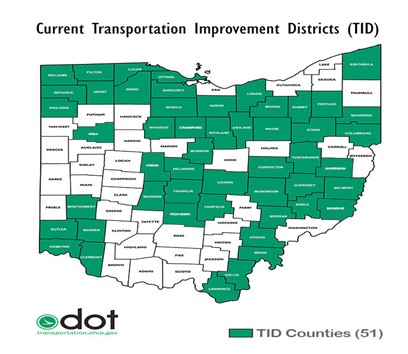

Ohio Transportation Improvement Districts. The state of Ohio operating budget authorizes the Speaker of the House of Representatives and President of the Senate to each appoint a nonvoting member, who may be but need not be, a member of the General Assembly to a Transportation ImprovementDdistrict (TID) board of trustees. In Ohio, Transportation Improvement Districts or TIDs are special assessment districts that promote intergovernmental and public-private cooperation to develop transportation resources and investments to solve these infrastructure challenges. TIDs are mechanisms to raise revenue for repair of roads, highways, and bridges within a defined geographic area. Districts are governed by a board whose job is to identify priority improvements, oversee financing, construction, maintenance, and repair of highways and roads. To complete these tasks, districts must capture funding, which they do by imposing taxes, tolls, or other fees. Revenue raised from these taxes or fees is returned to the city or county’s transportation improvement fund.

Ohio Tourism Development District. The state of Ohio operating budget clarifies that a municipality or township may enlarge the territory of an existing Tourism Development District (TDD) after December 31, 2020, the deadline under continuing law for creating a new TDD. This provision allows for municipal corporations to assess fees on property owners within a TDD if the TDD is being enlarged, and authorizes municipal corporations and townships in a county with a population between 375,000 and 400,000 that levies no more than a 0.5% county sales tax to designate a special district of not more than 200 contiguous acres as a TDD. Currently only Stark County meets the criteria. Ohio made substantial gains in changing their state economic development programs to support the retention and attraction of companies to the state. The Montrose Group has negotiated over $1 B in economic development incentives, including using many of these tax credit and other programs, and please contact Dave Robinson at [email protected] if you have any questions on this or other matters.