Federal New Market Tax Credits provide a funding source for companies considering a corporate site location projects located in federally designated low income areas. The Federal New Markets Tax Credit provides a 39% Federal Tax Credit Over 7 Years and $1M Ohio Tax Credit paired with Federal Credit for real estate investments in poor communities through complex transactions involving retail, office, and manufacturing projects. Established in 2000, the New Markets Tax Credit is a bipartisan effort to stimulate investment and economic growth in low-income urban neighborhoods and rural communities. Since then, the New Markets Tax Credit has financed more than 6,500 projects and created over one million jobs in all 50 states, the District of Columbia and Puerto Rico. In 2020, the Congress enacted a five-year, $25 B annual extension of the New Markets Tax Credit program.

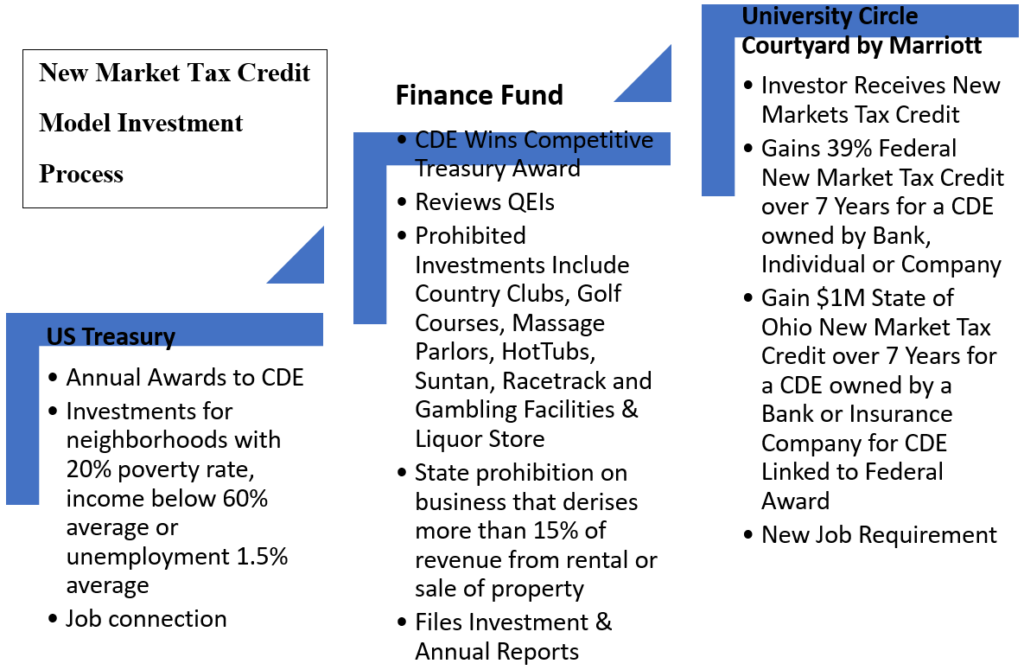

New Market Tax Credits follow a federal government prescribed process to gain access to the tax credits. As the example outlined below illustrates, the U.S. Treasury awards an allocation of New Market Tax Credits to a certified Community Development Entity (CDE) who then awards the tax credits to company or organization that qualifies for the program and plans an investment in a census tract eligible for New Market Tax Credit awards. The typical project involves at least a $15M New Market Tax Credit allocation due to the transaction costs of the process. A wide range of investment options exist including industrial, residential and retail projects.

The challenge for use of this program is the demand for projects far exceeds the availability of New Market Tax Credits. The federal program most comparable to Opportunity Zones (OZs) is the New Markets Tax Credit (NMTC), though OZs offer improvements over the NMTC program.[i] Both use tax incentives to encourage private investment in low-income communities, but the total tax benefit available through the NMTC program is capped, limiting how much investment it can spur.[ii] In most years since 2007, Congress has authorized the NMTC program to award tax credits to support about $3.5 billion in place-based investments.[iii] On average, these credits account for about half of total project costs, so the program supports roughly $7 billion in investment annually.[iv] As of 2016, nearly 3,400 census tracts have received NMTC program credits since the program’s inception in the early 2000s .[v]

NMTCs have been used by companies and communities to promote economic investment. The CDFI Fund targets 20 % of NMTC allocation awards to non-metropolitan counties. Between 2003 and 2014:

- 817 businesses, community facilities, and other important revitalization projects financed;

- $6.15 billion in NMTC allocation generated $11.6 billion in total project costs; and

- NMTC projects generated 49,940 full-time jobs and 21,706 construction jobs.

Manufacturing has been the most popular use of NMTC-financing for several years running. In 2018, CDEs financed 53 manufacturing projects and an additional 26 projects included a manufacturing component. Altogether, those projects supported 193 manufacturing businesses ranging from a jewelry manufacturer in Philadelphia, PA to a 250,000 sq. ft. expansion of a fiberboard manufacturer in Barnwell, SC. Below are a few stories of how small towns and manufacturing companies put NMTC capital to work through manufacturing expansions, timber and forestry projects, hospitals, and community facilities.

- Peterson Farms. The Peterson Farms project involved equipment purchase and installation for four capacity expansions to allow the company to continue to grow in Shelby, Michigan rather than move to another state, and in so doing, increase procurement from Michigan growers.[i] NMTC financing supported a portion of the project including the addition of a juice bottling line that will allow Peterson Farms to utilize commodities that might have been scrapped due to overproduction, addition of a second applesauce line, and a portion of capacity improvements to the blueberry processing line.[ii] The remaining capacity improvements to the blueberry line and acquisition of new apple peeling equipment were completed outside of the NMTC transaction.[iii]

- Mirac, Inc. A $7.55 million investment in Mirac, Inc., a rural Ohio-based electronics assembly and fabrication company with locations in Lynchburg and West Union, that will help keep jobs in rural Ohio.[iv] This project created 100 permanent jobs in rural Ohio.[v]

- Woodward Opera House. A renovated Woodward Opera House has been transformed into the Woodward Arts Complex that has updated retail and office space for as many as 29 tenants, a 500-seat theater, two recital and multipurpose rooms, dressing rooms and conference spaces in rural Mount Vernon, Ohio.[vi] The Woodward will also be a fresh food hub in what was previously a complete food desert, and the property will help alleviate the fresh food shortage by including a cafe that serves local food and a community kitchen available for local farmers to process or package their produce.[vii]

- North Carolina Renewable Power Lumberton. NC Renewable Power (NCRP) will retrofit an existing dormant coal-fired power plant to a renewable energy power plant utilizing biomass, in particular, poultry litter and wood waste: retrofit a dormant coal-fired power plant to a 25MW renewable energy power plant utilizing locally sourced poultry litter and wood waste. The NCRP plant is in rural Robeson County, one of NC’s poorest areas and a region dominated by large scale poultry production. Water runoff from poultry litter pollutes local waterways. NCRP’s use of poultry litter helps local farmers and removes a significant amount of poultry litter from the community. NCRP is only the second utility scale power plant in the U.S. utilizing a high %age of poultry litter.