Nearly all fifty states have a prime economic development incentive program used to retain or attract companies with high-wage jobs in targeted, high-growth industries. Florida’s Qualified Target Industry Tax Refund Program (QTI) was the prime economic development incentive the state of Florida used to retain and attract businesses to the Sunshine State. The QTI Program was designed to encourage the creation of high-skill jobs and encourage the growth of corporate headquarters and other targeted industries. QTI provided a tax refund of $3,000 per new job created in Florida through the expansion of existing Florida businesses or the location of new ones. This increased to $6,000 per job within an Enterprise Zone or Rural County. A business is eligible for a $1,000 per job bonus if it pays over 150% average wage in the area, and a $2,000 per job bonus if over 200%. Projects must be supported by their community to the amount of 20% of the incentive.

Florida’s QTI Program expired on June 30, 2020 leaving the state without a prime economic development tax credit program driven by job creation. This is simply stunning. Florida is left competing with regional neighbors who all have state economic development incentive programs, including:

- Alabama Jobs Act Jobs Credit is a discretionary program allowing an eligible company a cash rebate of up to 3% annually of the previous year’s payroll (not including fringe benefits) for eligible employees in for up to ten years.

- Georgia’s Job Tax Credit Program in exchange for creating new jobs in a specific industry sector such as manufacturing, distribution, and data processing, non-refundable tax credits ranging from $1,250 to $4,000 per year may be available for each, new job created for up to five years.

- Georgia’s Mega Project Tax Credit is designed to reduce a company’s payroll withholding liability and incentivize larger projects creating a significant number of jobs for companies hiring at least 1,800 new, full-time employees and either invest a minimum of $450 M or have an annual payroll of $150 M.

- Georgia’s Quality Jobs Tax Credit provides a tax credit to companies creating at least 50 high-paying jobs paying at least 10% above the average wage of the county in which the jobs are created.

- Mississippi’s Jobs Tax Credit reduces manufacturers, wholesalers, processors, R&D facilities, and distributors’ income tax liability for jobs within a Tier I (20 jobs gains a 2.5% payroll credit), II (15 jobs receives a 5% payroll credit), or III (10 jobs receives a 10% payroll credit) per job in the county and are capped at 50% of a business’s income tax liability, and be carried forward for five years.

- South Carolina Job Tax Credit offers companies relocating or establishing a corporate headquarters or a manufacturing, distribution, processing, service-related, and research/development business in state a non-refundable tax credit eliminating up to 50% of tax liability for a credit ranging from $1,500 to $25,000.

- South Carolina’s Corporate Income Tax Moratorium offers companies in distressed counties a up to a 10-year moratorium and 15-year moratorium if company is creating 200 jobs to eliminate their state, corporate income tax liability for up to ten to 15 years. To qualify, at least 90% of a company’s total investment in the State must be in a county where the unemployment rate is twice the state average.

Florida’s answer to the lack of state incentives will be to use the existing local government tax incentives offered across the state. Pasco County Job Creation Incentive Program offers between $2,000 and $5,000 per new job created by businesses that create ten or more new jobs, pay above average wages with a majority of sales outside of the county. The Nassau County Economic Development Grant program offers a grant of 100% of real and personal property taxes due on the level of new capital investment and new jobs for companies creating at least ten new jobs with $1 million in new capital investment and paying on par with county wage averages. Tampa’s Economic Development Ad Valorem Tax Exemption reduces these taxes by 50%-75% on a three-tier system for five to 10 years based on the number and types of jobs created, average annual wages and location of the business. Pinellas County Job Creation Tax Credit permits incentives of $500 for each new job paying 150% of average county wages and $1000 for each job paying 200% of average county wages for companies with two hundred fifty or more new full-time jobs created, with $50 million or more in new capital investment, in a targeted industry. Finally, the Miami-Dade Targeted Jobs Incentive Fund offers existing or relocating companies in targeted industries a tax refund of 80% of the amount of incremental county-wide ad valorem property taxes for companies that create at least 10 jobs, pay above average wages with $3 M in capital investment in targeted industries.

Unfortunately for Florida, their competitors are not without local economic development incentives either. Alabama Enterprise Zone Program offers businesses locating within a zone may be eligible to receive a maximum credit of up to $2,500 per new, permanent employee or may be eligible for discretionary sales and use, income, and business privilege tax exemptions for up to five years, and the credit amount is calculated based upon number of jobs created and increment formula, capital investment levels, and employee training costs. South Carolina Five-Year Property Tax Abatement allows manufacturers and distribution/corporate headquarters facilities investing $50,000 or more creating 75 new jobs in one year may receive a five-year property tax abatement from county operating taxes which is an offset of up to 20% to 50% of the total millage in a county and does not include the school portion of the local millage, the abatement may not be combined with property placed under a Fee-in-Lieu agreement, the state also offers local property tax exemptions for rehabilitating abandoned textile mills, other abandoned buildings, and does not levy property tax on inventories, tangible property, and pollution control equipment. Mississippi local governing authorities may grant a property tax exemption for up to ten years on real and tangible personal property being used in the state for all local property taxes except school district taxes and applies to manufacturing, warehousing, and R&D.

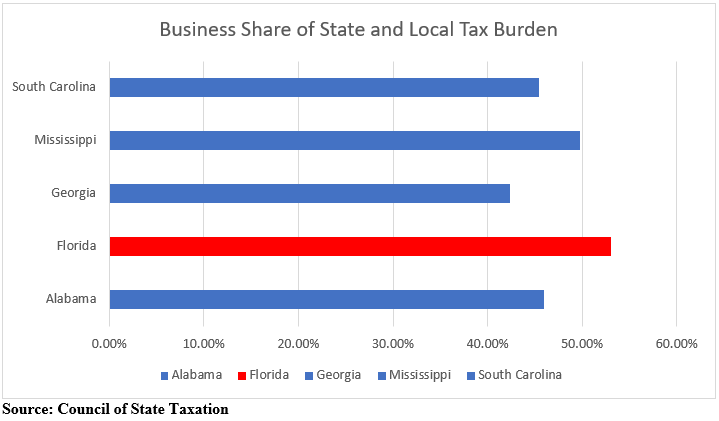

The decision of Florida state government officials is every more startling considering the state places a higher burden on taxing businesses. As data from the Council of State Taxation 2019 business tax burden study indicates in the chart below, Florida actually places a higher burden of its local and state tax share on businesses compared to their regional competitors. This illustrates to companies considering staying in Florida or considering Florida as part of a strategy to grow in the Southern United States that Florida not only lacks a major state economic development incentive program but they also generally tax business more than other Southern states.

Florida’s termination of their prime economic development incentive and the subsequent economic success or failure in the current decade may well illustrate whether business tax rates and economic development incentives truly impact the growth and success of regional economies. It is a gamble the state of Florida has decided is worth the risk. Time will tell whether they were correct.