A mullet, the infamous haircut of the 1990s, is thankfully not a trend but a fad. Trends are longer term and has a lasting impact. From an economic standpoint, globalization is an example of a trend impacting corporate site location that has driven many U.S. companies to search for lower cost global production facilities as well as opened up the U.S. and global markets to additional economic competition. Corporate site location trends tied to regional economic development provide a guidepost for what companies and communities should do to impact their economic success.

Driven by changes in technology, demographics, and public policy, 2019 is promising to be a big year for corporate site location. Annually, Montrose Group releases their top ten corporate site location trends meant to guide companies and communities looking to grow high-wage jobs and capital investments. Montrose’s top ten corporate site location trends of 2019 cover a wide range of public policy, industry, demographic, workforce, financing and public infrastructure issues that will all impact the corporate site location decisions of companies looking at the United States as a potential market for investment.

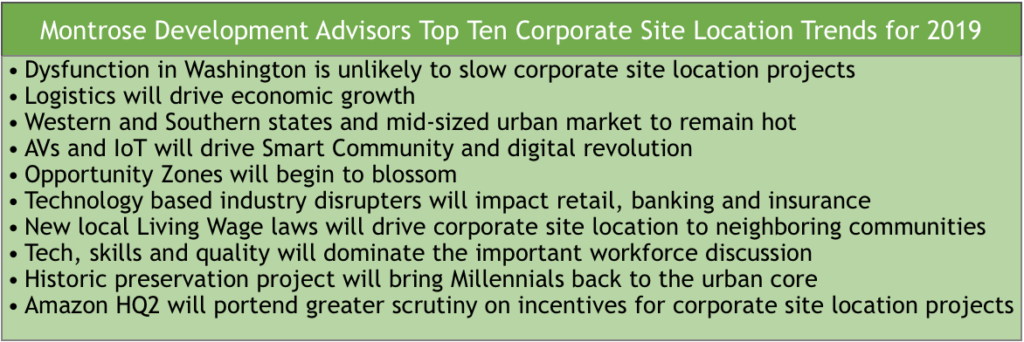

Montrose Group top ten corporate site location trends for 2019 include:

- Political dysfunction in Washington is unlikely to negatively impact corporate site location projects in 2019. Most public policy decisions impacting corporate site location projects are driven at the local and state level, and Trump Administration efforts to address the trade imbalance, reduce regulation on business and implement tax reform are having a generally positive economic impact which supports additional domestic corporate site location projects but addressing infrastructure needs could drive growth further as the implementation

- Driven by explosive e-commerce growth, logistics and distribution will be a leading economic development driver as retail companies adjust to changing consumer behavior. Large big-box retailers will follow the Amazon model to a certain extent creating substantial demand for new logistics, distribution and fulfillment centers across the United States.

- Western and Southern states and mid-sized, urban markets will be the sites of choice for growing companies grow based upon their population migration, lower cost of living, large labor pool and highly competitive wage rates. High-cost East and West Coast markets will remain attractive for certain projects but more technology and logistics projects can be expected in mid-sized urban markets throughout the United States in 2019.

- 2019 will be a good year for Smart Community’s. Billion dollar investments in Autonomous Vehicles and Internet of Things technology will transform American cities into Smart Community’s as they shift to a digital model to manage transportation, public safety, public utilities and other local government services through collecting data, building sensor networks and creating applications improving people’s lives.

- Opportunity Zones, a federal program that can eliminate capital gains on investments in 8700 census tracts, will begin to attract capital to struggling sites in 2019. To capitalize on Opportunity Zone opportunities, developers and communities will need to develop Opportunity Zone prospectus, adopt Opportunity Zone public policies to provide infrastructure and incentives and create regional and real estate based Opportunity Zone funds and look for tech leaders jump in as early Opportunity Fund investors in the coming year.

- Industry disruptors, large and early-stage companies changing the way retail, health care, insurance and financial services operate, will drive new economic development projects as technology and changing consumer behaviors hit traditional industries. Many traditional companies in these industries will struggle to adapt to uses of AI and IoT but a new generation of companies will be born on a large flow of venture capital.

- Locally enacted Living Wage mandates will negatively impact corporate site location projects in 2019. State governments that take a more thoughtful statewide approach accomplish the same noble policy goals of focusing larger economic development incentives on higher wage jobs are likely to gain in 2019 as well as the neighboring communities who have not adopted Living Wage mandates next to their often larger neighbor that has.

- Technology, skills over tenure and quality of work to dominate the workforce discussion in 2019. Workforce development, with the rise of the Millennials and retirement of the Baby Boomers will continue to dominate economic development and have a strong impact on corporate site location projects. Regions that implement successful workforce development programs geared toward their industry priorities are most likely to succeed in the coming year.

- Historic preservation projects will bring Millennials back to communities large and small in 2019. Small communities in particular with a large base of historic structures in aging Downtowns and a long-term decline in population will run to the redevelopment of their historic Downtowns as a prime tool to attract residents and a new generation of entreprenuers back to their community.

2019 will be a big year for corporate site location and those companies and regions focused on ‘where the puck is going’ are likely to gain a competitive advantage over those that do not. The top ten corporate site location trends for 2019 was developed based upon corporate site location project and regional economic development plan research and the experience of negotiating corporate site location deals in the United States by leadership of Montrose Group. Montrose Group, LLC is an economic development consulting firm that provides corporate site location, economic development planning, and project financing services to companies and communities alike. Leadership of Montrose Group negotiated over $1.2 B in economic development incentives, completed two dozen economic development strategic plans.