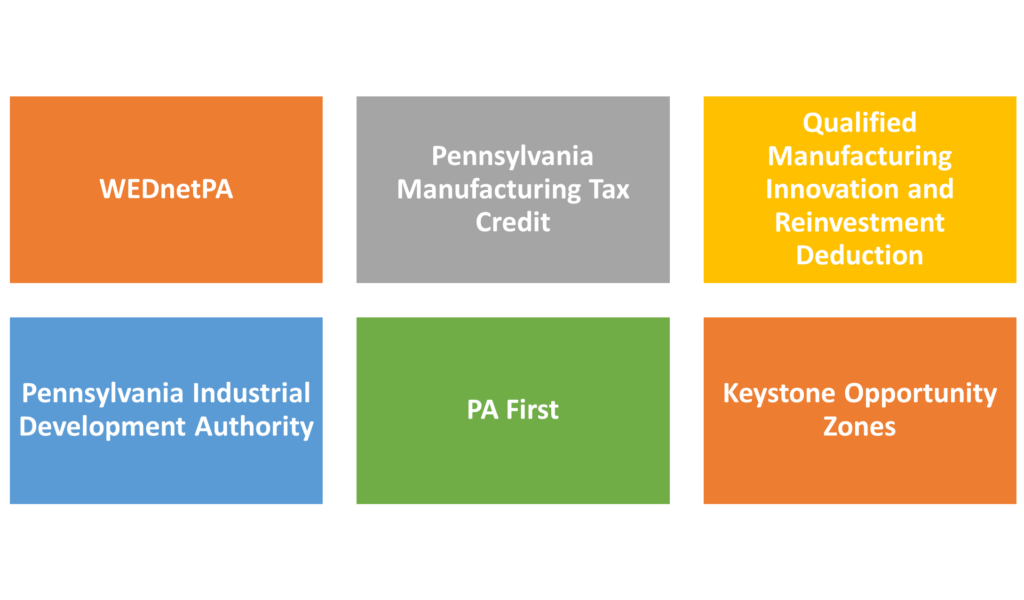

WEDnetPA. The WEDnetPA program provides qualified employers with training funds for new and existing employees. Funding can be used for a wide range of incumbent worker training. The training must be skill-building for the employee’s current job or for advancement or promotion. Funding eligibility requires that: Employees to be trained must be residents of and employed in Pennsylvania; Employees to be trained must earn at least 150% of the current federal minimum wage, excluding benefits; and employees to be trained must be permanent, full-time employees and eligible for full-time benefits. An individual employee can qualify for up to $2,000 in job skills training. Company participation is limited to two years in a row and three out of the past five years. Training must occur from July 1 to June 30 of the fiscal year of the funding award.

Pennsylvania Manufacturing Tax Credit. The Manufacturing Tax Credit (MTC) Program provides tax credits to taxpayers who increase their annual taxable payroll by $1,000,000 through the creation of new full-time jobs. Tax credit awards shall be equal to 5% of the taxpayer’s increase in annual taxable payroll if increased by at least $1,000,000 above a pre-determined base year amount. Those eligible to apply are qualified taxpayers who increase their annual taxable payroll by $1,000,000 through the creation of new full-time jobs.

Keystone Opportunity Zones provide certain state and local tax abatement to businesses and residents located in designated zones. Businesses, property owners and residents that are located in a KOZ, KOEZ/KOIZ are eligible to receive significant state and local tax benefits. Pennsylvania businesses relocating to a KOZ/KOEZ must either: Increase their full-time employment by 20% within the first full year of operation or make a 10% capital investment in the KOZ/KOEZ property based on their prior year’s gross revenues. Eligibility for benefits is based upon annual certification. In order to receive benefits, any entity applying must be compliant with all local and state taxes and building and zoning codes.

Qualified Manufacturing Innovation and Reinvestment Deduction. Qualified Manufacturing Innovation and Reinvestment Deduction encourage increased investment and job creation through manufacturing in Pennsylvania. Qualified businesses are eligible to deduct five percent of their private capital investment from their corporate net income tax liability if they invest more than $100 million in the creation of new or refurbished manufacturing capacity. Eligible applicants are manufacturing entities registered to do business in PA and subject to Corporate Net Income Tax and can obtain and maintain state tax compliance clearance status with the laws and regulations of the Commonwealth of Pennsylvania. Eligible projects will include the creation of new manufacturing capacity or improvements to existing manufacturing capacity at an identified project site. Limited to the mechanical, physical, biological, or chemical transformation of materials, substances, or components into new products, that are the creations of new items of tangible personal property for sale. The deduction will be equal to five percent of the private capital investment utilized in the creation of new or refurbished manufacturing capacity per tax year for a period of five (5) years.

Pennsylvania Industrial Development Authority. Pennsylvania Industrial Development Authority (PIDA) provides low-interest loans and lines of credit for eligible businesses that commit to creating and retaining full-time jobs and for the development of industrial parks and multi-tenant facilities. This money can be used for: Land and building acquisitions; Construction and renovation costs; Machinery and equipment purchases; Working capital and accounts receivable lines of credit, Multi-tenant facility projects; Industrial park projects. A variety of different industry sectors are eligible for PIDA financing including manufacturing, industrial, agricultural, research and development, hospitality, defense conversion, recycling, construction, child day-care, retail and service, export, and computer-related service enterprises. The PIDA program finances a portion of total eligible project costs.

PA First. PA First is a comprehensive funding tool to facilitate increased investment and job creation within the Commonwealth. Funding can be used for Machinery/equipment; Job training; Infrastructure; Land and building improvements; Environmental assessment/remediation; Acquisition of land, buildings, rights-of-way; Working capital; Site preparation. Businesses, Municipalities, Municipal Authorities, Redevelopment Authorities, Industrial Development Authorities or Corporations, and Local Development Districts are all eligible for PA First funding in the form of grants, loans, and loan guarantees. Competitive projects must offer substantial economic impact, either for the Commonwealth as a whole or for the locality or region in which a business will locate or expand; private match required; job creation/preservation required.

Keystone Opportunity Zones. Keystone Opportunity Zones (KOZs) are areas designated by the Commonwealth of Pennsylvania that would benefit from additional investment. Businesses in these areas are exempt from most business taxes. The Department of Commerce manages this program for properties in Philadelphia. KOZs target sites that are abandoned, unused, and underutilized. Properties and businesses located within these designated zones pay little-to-no state and local business taxes using tax credits, tax waivers, and broad-based tax abatements for a term.

Pennsylvania, like their other Great Lakes counterparts, has a wide array of economic development incentives designed to retain and attract job producing companies.