Taxes levied by local and state governments have a major impact on a company’s corporate site location decisions. Taxes by the state and local governments are a critical component of measuring the cost of doing business in a region. Different local and state governments tax businesses differently. What and how much local and state governments tax business is a policy decision not just to collect the revenues needed to pay for schools, roads, water, public safety, and other essential services but is also a public policy decision impacting a company’s corporate site location.

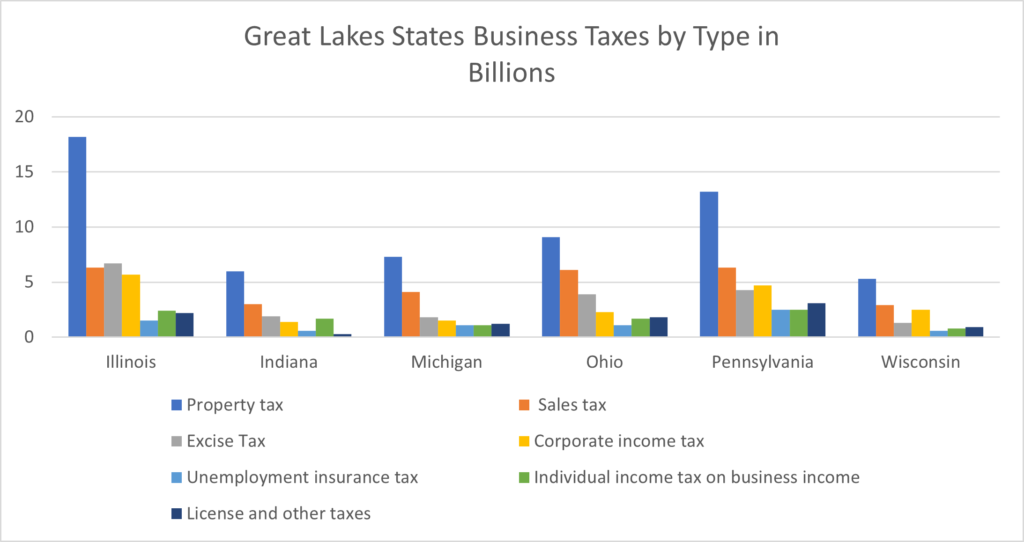

Ultimately, how much taxes a company pays at a location impacts its decision as to whether to locate in the region and defines the critical role of economic development incentives. The specific taxes a company will pay at a site is a critical cost of doing business factor the local and state government can directly impact through tax incentives. As the chart below illustrates, Illinois leads the Great Lakes states when it comes to taxing business. Illinois taxes business, according to the Council of State Taxation a total of $43 B which is $7B more than Pennsylvania and $17 B more than Ohio both of which are of similar size. Smaller states such as Illinois and Wisconsin in the Great Lakes charge businesses substantially lower taxes than the larger states. It is worthy of note that property taxes are the highest business tax in nearly all the states and all these states also have some form of an income tax. However, an important factor for companies to consider when reviewing this state and local tax data is what taxes will their company pay more. Large-scale industrial investments will drive up property taxes if the state taxes equipment. Some states have property taxes on inventory again which impacts different companies differently. Finally, companies in the advanced service or white collar or technology industries may not really care about property tax as they have moved to a near virtual office presence and won’t pay substantial property taxes.

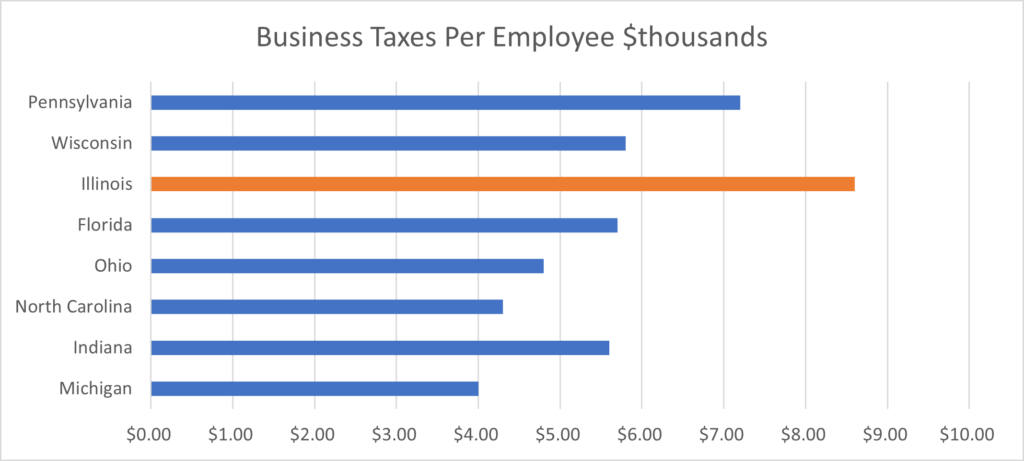

Measuring business taxes on a per-employee basis is a method that can provide a company considering a corporate site location project with a good basis for a state’s overall business-friendly attitude. This approach addresses population differences in the states. As the table below illustrates, companies in Illinois land in the middle compared to other Great Lakes states with Illinois and its global mega-city Chicago having the highest taxes on a per-capita basis on businesses while southern states like North Carolina and Florida tax business less than many Great Lakes states. More troubling for Illinois is that Michigan and Ohio companies pay less taxes than companies in Illinois.

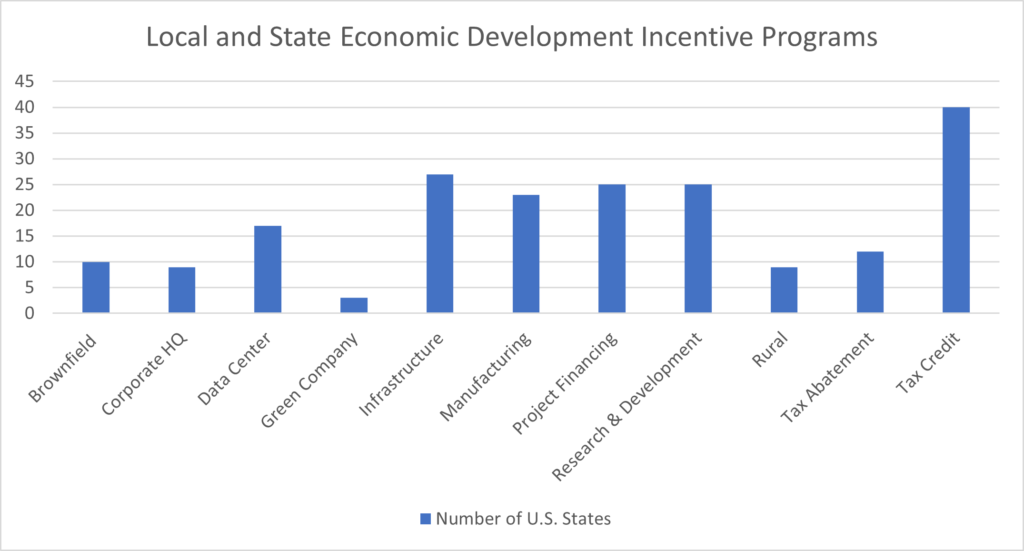

According to the Council of State Taxation, businesses paid $951.4 B in state and local taxes in FY21, which was 43.6% of all tax revenue at the state and local levels. Businesses paid $493.7 B in state taxes in FY21, which was 17.0% higher than the prior fiscal year, and $457.6 B in local taxes, which was 10.2% higher, for a combined year-over-year growth rate of 13.6% over FY20. To address the regional cost of doing business factors, all fifty states offer some form of economic development incentives. As the chart below outlines, infrastructure incentives are provided by all the states in the union followed by tax credits as the second most popular tax incentive program in the nation with efforts to attract data centers and using general tax abatements tying for third. Princeton Economics estimates that state and local governments invest about $30 B dollars in economic development incentives annually.

Illinois has many economic development incentives offered to companies looking to create jobs and make capital investments in the Land of Lincoln state.

The Intersect Illinois leads the marketing effort for the state of Illinois for companies considering growing in the state. Illinois, like the other Great Lakes States, offers a wide range of state economic development incentives are provided for job creation and business investment, redevelopment and quality of place, innovation and entrepreneurship, research, and development, site development and skills training, including the following incentive programs:

- Illinois’ Data Center Investment Program provides new and existing, carbon neutral data centers making an aggregate investment of $250 M over a 60-month period with exemptions from state and local taxes (and a 20% credit towards wages paid for construction workers in underserved areas), and eligible centers must create at least 20 full-time equivalents in aggregate and meet or exceed compensation totaling 120% of the median wage paid to FTEs in the county where the center is located.

- Illinois Growing Economy Tax Credit Program (EDGE) provides annual, non-refundable, income tax credits to businesses supporting job creation equal to 50% of the income tax withholdings of new jobs created in Illinois (up to 75% if located within an underserved census area) employer eligibility depends upon its number of world-wide employees. A new policy revises Illinois’ EDGE Tax Credit with new provisions that substantially ease “but/for” requirements. One impact is that businesses no longer have to report on incentives from competing states. It also doubles the credits for retained employees in underserved areas to 50% from 25%. A termination clause gives businesses five years to achieve their job creation and investment commitments.

- Illinois High Impact Business Program supports tax credits for companies with a minimum investment of $12 M and create 500 FTE’s, or $30 M of investment with a retention of 1,500 FTEs. This program cannot be used in conjunction with the Enterprise Zone Program.

- The Invest in Illinois fund devotes $400 million to high-priority projects that commit to investing and creating jobs in Illinois. This means that expanding or relocating companies can receive cash assistance to help with up-front costs associated with their projects. Safeguards are in place to ensure that job creation and investment numbers are met, but the process for allocating funds to worthy projects is simple and intended to help large deals close quickly.

- Illinois Enterprise Zone Program awards a mix of state and local tax incentives for reductions in a retailers’ occupation tax, state utility tax, and purchases on personal property used in manufacturing process and local incentives such as Cook County industrial property EZs receives special consideration under the Class 6b – Industrial Program and is generally assessed at 25 percent of market value in the absence of any incentives. This program cannot be used in conjunction with the High Business Program. Recent changes, and recent changes in the EZ act amends the program to expand the size of these zones, allowing for local communities to be more competitive when attracting businesses.

- Illinois Small Business Emergency Loan Fund offers small businesses located outside of the City of Chicago with fewer than 50 workers and less than $3 M in revenue in 2019 low interest loans of up to $50,000. This fund was created in response to the COVID-19 pandemic. It is not an ongoing incentive.

- Illinois Tax Increment Financing captures future property tax growth in a defined district for the redevelopment of substandard, obsolete, or vacant buildings, financing general public infrastructure improvements, including streets, sewer, water in declining areas, cleaning up polluted areas, administration of a TIF redevelopment project, property acquisition, rehabilitation or renovation of existing public or private buildings, construction of public works or improvements, job training, relocation, financing costs, including interest assistance, studies, surveys and plans, marketing sites within the TIF, professional services, such as architectural, engineering, legal and financial planning, and demolition and site preparation. The state of Illinois offers a wide range of economic development incentives for companies considering a corporate site location project.

- Illinois’ Reimagining Electric Vehicles (REV) Act, passed in 2021, offers 75-100% income tax withholdings exemptions and credits for workforce training, construction jobs and investment, to attract companies in the electric vehicle sector with a minimum investment threshold was also lowered to $2.5 million from $20 million. Companies are required to create 50 new jobs or a number equivalent to 10% of their global workforce, whichever is lower, within four years.

- Manufacturing Illinois Chips for Real Opportunity (MICRO) Act to attract semiconductor companies looking to relocate or expand in the U.S. The new legislation significantly boosts tax credits for retained employees of semiconductor projects from 25% to 75%, rising even further to 100% for those locating in an underserved or energy transition area.

Illinois like their other Great Lakes counterparts, has a wide array of economic development incentives designed to retain and attract job producing companies.