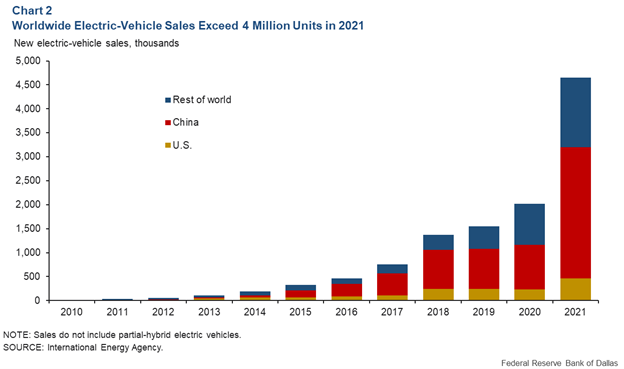

The transition of the global auto industry from internal combustion engages to Electric Vehicles (EVs) is not news. While EVs still make up a relatively small share of overall sales in the U.S., sales have risen considerably in recent years. According to the Dallas Federal Reserve Bank, sales in 2021 totaled more than 466,000 units, double the level in 2020. These trends have been even more pronounced outside the U.S. where, on average, sales have doubled each year since 2010 and reached almost 4.2 million units in 2021. China, in particular, has experienced robust sales growth.

Driven by this increased demand for EVs, the last several years have seen and we continue to see the announcement of major EV manufacturing facilities across the United States. The boom in EV battery production facilities across the United States illustrates the potential economic development benefit of these megaprojects to develop EV battery production facilities as well as to retrofit or build new EV auto assembly plants.

As a result, there is a wave of new investment in gigafactories—enormous facilities devoted to the production of lithium-ion batteries. Planned investment exceeds $40 billion according to the Dallas Federal Reserve Bank. First, let’s understand what is a gigafactory. Individual batteries, technically known as “cells,” come in a wide variety of shapes, sizes, and chemistries. For example, a common AA battery is an alkaline cell. Cells are produced in factories ranging in size from small, pilot production lines to enormous facilities covering hundreds of thousands of square feet that produce millions of cells per year. Their annual capacity is measured not in terms of the number of cells produced but rather in terms of the total energy capacity of all those batteries.

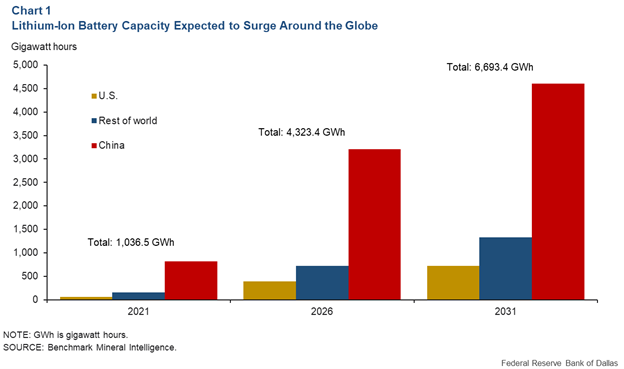

According to the Dallas Federal Reserve Bank, experts expect these new investments, as well as future ones, to significantly boost U.S. production of lithium-ion batteries- see Chart 1 above. U.S. capacity is expected to grow more than fivefold from 2021 to 2026, according to data and estimates by Benchmark Mineral Intelligence, a data and market intelligence provider. By 2031, U.S. capacity is expected to expand another 86 percent.

While this will boost the U.S. share of global capacity, current forecasts imply that it will remain modest, advancing from 5.5 percent in 2021 to almost 11 percent by 2031. Other areas of the world—particularly China—are also experiencing gigafactory booms. China’s production capacity, which already overshadows all other countries, is expected to rise about 486 percent from 2021 to 2031 according to the Dallas Federal Reserve Bank.

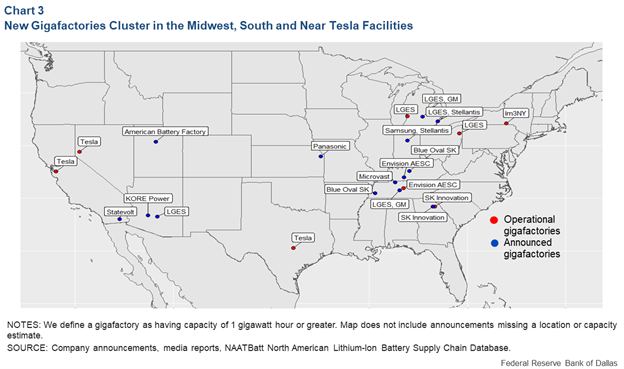

Plans of the global auto industry illustrate the need for EV gigafactories. Six new EV battery facilities, worth more than $5 billion, were announced from 2018 to 2020. Since the start of 2021, more than 15 new facilities or expansions have been disclosed in the U.S., reflecting a potential investment of at least $40 billion. Several plants have also been announced in Canada. The production capacity of these just-announced gigafactories generally dwarfs that of the earlier facilities, which was often less than 1 GWh. All but one exceeds 10 GWh of capacity, with the largest exceeding 40 GWh. Ford plans to spend $50 billion through 2026 to expand its EV production, while GM plans to invest $35 billion through 2025. Both also have ambitious targets for global sales, with Ford targeting 2 million units by 2026 and GM 1 million by mid-decade. Other companies with a footprint in the U.S. are also preparing plans to scale up production in the region. Auto production for these companies is largely concentrated in the Midwest and the South. Due to the high costs of transporting large quantities of lithium-ion batteries, most of the newly announced gigafactories will be in the same geographical region, an area some have begun referring to as the “Battery Belt” (Chart 3).

The map above from the Federal Reserve Bank of Dallas illustrates the explosive growth of large-scale EV battery projects that will drive additional automotive industry growth as that industry transitions away from Internal Combustion Engines to EVs. EV investments will continue going into 2023 as well as the development of the supply chain tied to the investments announced in 2022.

Another feature of many of these investments is that they are partnerships between automakers and battery producers. For example, the largest investment recently announced is a $5.8 billion joint project by Ford and SK Innovation for two 43 gigawatt-hour-capacity facilities in Kentucky. These partnerships allow battery companies to secure demand while allowing automakers to obtain the supplies they need to produce EVs.

Michigan has not been left out of the boom of EV megaprojects. According to the Michigan Economic Development Corporation, since 2019, Michigan has created over 35,000 auto jobs. Investments include:

- May 2019: Stellantis announced the first new plant in Detroit in nearly 30 years, creating 6,000 jobs.

- December 2019: Ford announced a $1.45 billion investment creating 3,000 jobs to help produce the first-ever electric F-150.

- October 2020: GM announced a $2.2 billion investment to build Factory Zero creating 2,000 jobs.

- January 2022: General Motors announced a $7 billion investment—the largest in company history—creating 4,000 jobs and retaining 1,000 jobs, to convert Orion Township assembly plant to build full-size electric vehicle pickups and build Ultium’s third U.S. battery plant in Lansing.

- March 2022: LG Energy Solution announced a $1.7 billion expansion creating 1,200 jobs in Holland manufacturing batteries.

- June 2022: Ford Motor Company announced an investment of $2 billion, creating more than 3,200 jobs in plants across Michigan to support electric vehicle manufacturing growth and secure internal combustion engine portfolio in the state.

- June 2022: Canadian electric vehicle charging network operator FLO announced an investment of $3 million for the company’s first-ever U.S. manufacturing facility in Auburn Hills.

- October 2022: Michigan-based Our Next Energy announced a $1.6 billion investment to establish its first cell and electric vehicle battery pack gigafactory in Van Buren Township, creating up to 2,112 jobs.

- October 2022: Gotion announced a $2.36 billion investment for a new manufacturing facility in Big Rapids, creating up to 2,350 jobs.

- January 2023: Ford announced a $3.5 billion investment, creating 2,500 good-paying jobs, in a new EV battery manufacturing facility in Marshall.

Michigan like other auto producing states is in the middle of the EV facilities boom and more investment in this market is likely to continue.