Economic development organizations and communities have become accustomed to the traditional corporate site location process that positions sites for investment opportunities. EDOs have spent decades working to build and market an inventory of shovel-ready sites, equipped with water, sewer, electric, gas, broadband, and roads at the “front door” to those sites; communities have established incentives districts to demonstrate their commitment to having skin in the game to win projects; and site selection firms have developed advanced location analytics tools to find ideal geographic locations for clients. While these approaches to finding the ideal location play an important role in attracting companies, there is a shifting tide in the corporate site location process. Communities must look beyond traditional incentive programs and think about the new incentive – successfully attracting residents and workforce.

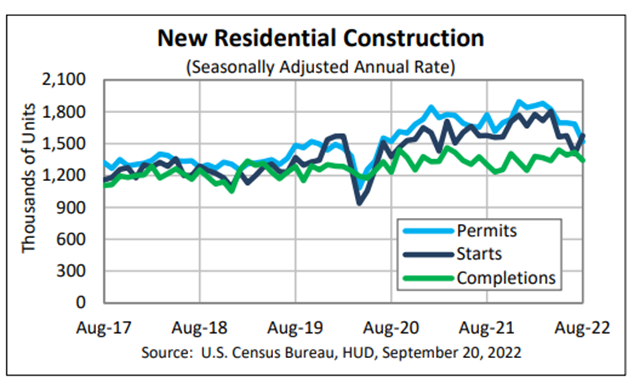

Record-high job openings, turnover, low unemployment, and local governments opposed to additional housing development have sent companies scrambling to find creative attraction and retention strategies, and housing has become one of them. Despite an uptick in new residential permits issued since August 2017, new housing completions is significantly lagging and creating a growing gap in the number of single-family homes coming online. Supply chain disruptions and price hikes incurred during the COVID 19 pandemic have not helped the national demand for housing stock, pushing companies to look for creative ways to bring new inventory online and close the labor demand gap.

Booming regions such as Columbus, Ohio are facing a crisis not driven by high-wage job creation but the lack of available housing. Supported by the global corporate site location win of gaining an $20 B Intel “fab” manufacturing plant, Columbus is expected to add over 50,000 jobs in the coming decade. The simple fact is Columbus has not been keeping up with their growth from a housing standpoint for decades. Housing experts estimate that one new housing permit is needed for every new, net job created. Thus, housing needs to be developed on a one-to-one ratio. According to a recent VSI study, the Columbus region has been developing 95 housing permits for every 100 net, new jobs created. More importantly, all income levels will need housing in the Central Ohio marketplace. From the rich to the poor, the availability of housing is a critical corporate site location factor.

Housing Costs Comparison for Growth Markets

| Fact | Indianapolis | Charlotte | Nashville | Columbus | Austin |

| Median Home Value | $145,200 | $235,000 | $264,600 | $160,000 | $358,600 |

| Median gross rent | $911 | $1,185 | $1,170 | $989 | $1,346 |

What Columbus and other growth markets don’t want is the rising housing costs of fast-growing markets such as Austin, Nashville, Charlotte, and elsewhere. As the table above illustrates, these booming urban markets are reaching the point of cost of housing impacting their competitiveness for corporate site location projects. Companies won’t locate in a region where their workers cannot afford housing.

Rural communities face the opposite challenge of booming urban markets. The depopulation of rural counties across the United States and the world, not only jeopardize the attraction of new companies to rural markets in search of workers but also does not attract much if any new housing development to these regions. Without new residential investment, the effort to retain rural residents is nearly impossible.

Rural communities across the U.S. are working to address this issue. In rural Dumas, Texas which has a population of 14,463, a local beef processing plant run by JBS USA Holdings Inc. recognized the need to attract workforce to its plant. JBS has undertaken an employee housing construction program to develop properties employees can buy, creating affordable workforce housing and incentivizing talent to move to the rural Texas community.[i] Through its JBS Hometown Strong program, an investment of $3.89 M will fund the construction of 64 single-family homes ranging between 1,200 and 1,800 square feet in the $180,000 and below price range.[ii]

In April 2022, Cook Medical announced its intentions to provide middle-income workers with workforce housing, which is in short supply in the rural, western Indiana counties of Owen, Orange, and Lawrence counties.[iii] After hearing from employees and surrounding communities, Cook Medical committed to helping remove some housing barriers for the

workforce in the region with an initiative to build 300 homes across south-central Indiana to address the critical need for workforce housing.[iv] To begin the project, Cook purchased 62 acres of land on Texas Pike in Owen County, across the street from the Cook Spencer facility and intends to sell many of the homes to employees at cost, or for less than $200,000, ensuring the talent they attract to their company will having housing available.[v]

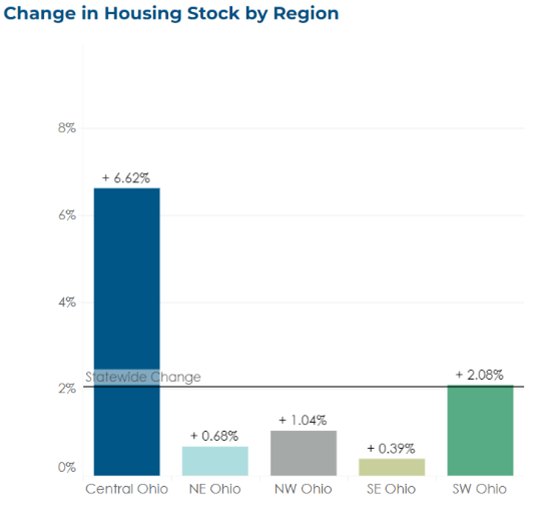

According to the Ohio Housing Finance Agency, Ohio’s housing stock has grown by 2.1% since 2010 which has outpaced population growth over the same period (+1.3%).[vi] Much of this growth happened in suburban areas, while Ohio’s urban cores have seen housing stock decline (–1.4%).[vii] At the end of 2019, homeowner and rental vacancy rates–1.1% and 6.8%, respectively–were near their lowest levels on record, indicating a very tight housing market.[viii] Add in the fact that Ohio’s housing stock is relatively old, with one-in-four housing units built before 1950 (27%), Ohio communities of all sizes must get to work to attract residential builders and increase housing stock if the state wants to remain an economic development powerhouse.

In northwest Ohio, the city of Bowling Green has been part of significant economic development activity within the region which is expected to bring thousands of new jobs over the next five years. Under the leadership of the city of Bowling Green and its economic development agency (BGED), the city went directly to regional residential developers with an opportunity to construct residential housing on BGED-controlled property. BGED was interested in developing 9 parcels within the city limits, representing approximately 247 total acres of vacant agricultural land. Through this process, BGED aims to engage a development partner to work with collaboratively to address the diverse residential housing needs in the City of Bowling Green, considering a mix of proposed residential uses, including single-family and townhome options.

Rural, urban, and suburban communities throughout the U.S. must take note of innovative residential housing projects being undertaken by major corporations in communities such as Dumas, Texas and west-central Indiana and community-led effort such as Bowling Green, Ohio to put themselves in the driver’s seat to lead the attraction of residential development and present compelling corporate site location advantages.

[i] https://nextmortgagenews.com/news/companies-use-housing-strategies-to-attract-retain-talent/

[ii] https://abc7amarillo.com/news/local/jbs-investing-in-more-affordable-housing-near-company-plants

[iii] https://www.cookmedical.com/newsroom/cook-medical-announces-workforce-housing-initiative-in-owen-county/#:~:text=Cook%20Medical%20today%20announced%20an,from%20the%20Cook%20Spencer%20facility.

[iv] Ibid.

[v] Ibid.

[vi] https://ohiohome.org/research/housingstock-hna.aspx

[vii] Ibid.

[viii] Ibid.