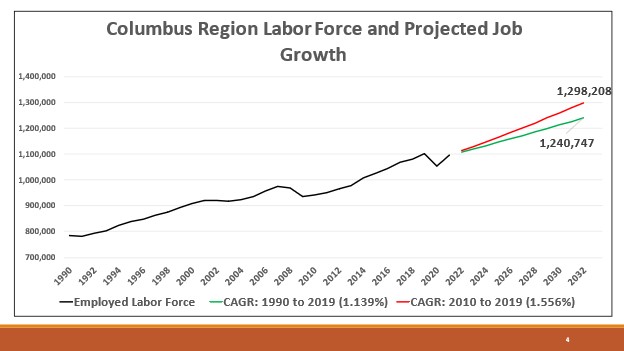

The Central Ohio region, anchored by Ohio’s capitol city of Columbus, is a fast-growing mid-sized metropolitan area in line with other large urban centers across the United States driven by population and economic growth. The 11-county Central Ohio region has a net gain of 238,000 people from 2010 to 2020 while the other 77 counties in Ohio have only added roughly 23,000 new residents. Columbus’ population is near 1 million people and has the same population as Cleveland, Cincinnati and Toledo combined. The Mid-Ohio Regional Planning Council (MORPC) suggests that the 15-county Central Ohio region continues to be on track to reach 3 million residents by 2050, compared to 2.2 million residents in 2010. This translates to nearly 1.2 million households and 1.5 million jobs in 2050. The same story can be seen in Austin, Raleigh-Durham, Nashville, and other fast-growing midsized urban markets. In addition, substantial new corporate site location wins that include a $20 B Intel fabrication facility and the $300 M Hyperion hydrogen car investment bringing 700 jobs are two 2022 corporate site location wins…

that illustrate the post-World War II growth pattern benefiting highly educated regions like Central Ohio will continue. As an example, a similar facility was developed in Chandler, Arizona—a Phoenix suburb was developed in 1980 and now 11,000 employees work in Chandler at the Intel site. This Intel development was one of the key factors that drove Phoenix’s population from 1.4 M in 1980 to 4.5 M today. Central Ohio’s job creation growth over the past several decades is substantial, and, as the table above illustrates is about to hit overdrive based upon the Intel and other economic development project announcements. The Columbus region is likely to have similar growth from the Intel investment as well as the overall growth trend of Central Ohio.

Residential development will not automatically happen in Central Ohio. Rural and suburban school districts in many cases are actively opposing residential development as creating additional financial pressure on school districts to serve students while providing fewer resources. Not all communities are open to new housing investments. Recently, voters in Etna Township in Licking County rejected a proposed residential development through the referendum process that overturned zoning approval granted by the Township Trustees. Residential developers had to seek reversal of a Jerome Township position to not approve residential development by successfully going to the U.S. Federal District Court. Traditional greenfield residential development also is now forced to compete for land with the booming industrial market.

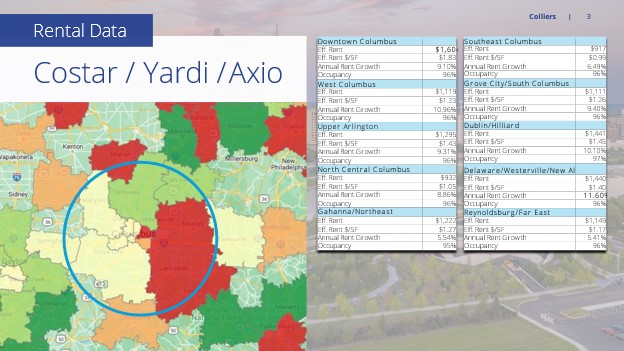

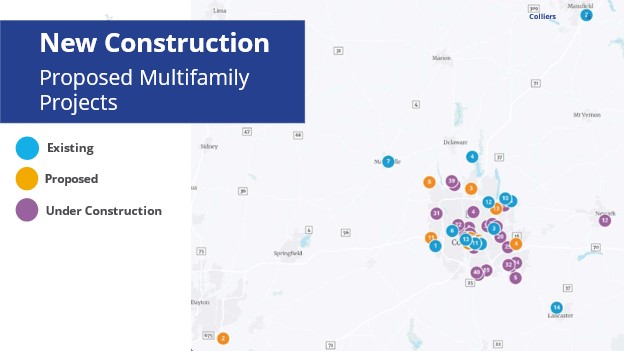

As the graphic from Colliers above illustrates, rents vary in different communities in Central Ohio. It is clear opportunities for residential development exists in Central Ohio worthy of consideration. Growing mid-sized communities like Columbus have an opportunity to meet the housing challenge through the development of multi-family projects in urban centers like Downtown Columbus. Downtown Columbus has traditionally been defined as the area between the box of Interstate highways, I-70 to the south, I-71 to the east, I-670 to the north, and State Route 315 on the west in the City of Columbus. The Columbus Capital Crossroads Special Improvement District (Capital Crossroads SID) reports that 11,200 people reside in Downtown Columbus and the pre-pandemic workforce was near 90,000 people making it a major jobs center competing with the suburban Easton Development and Polaris developments as the center for office jobs in the Central Ohio market. With 14 projects under construction and another 19 proposed, downtown could see close to 15,000 residents by the end of 2024 again according to the Capitol Crossroads SID. The population of Downtown Columbus still trails that of many peer cities, including Cleveland and Cincinnati. But, amid the Columbus region’s rapid growth in recent years, downtown reached a major milestone: surpassing 10,000 residents in 2020. According to the Capitol Crossroads SID, average rents and home prices climbed during the year, and the median sale price of owner-occupied units increased 12% from the previous year to $354,000 with one-bedroom rent prices soaring 20% to reach $1,393 per month.

The Downtown Columbus office market is struggling. According to a recent Colliers report, the Downtown Columbus vacancy rate hit 12.8 percent in Q4 2021 which is the highest it has been since 2011. New investments continue in Downtown Columbus. The traditionally strong Statehouse office tower market surrounding the Ohio Statehouse is at a historic weak position with many buildings facing 70% vacancy rates as companies have moved to the Arena District, and large corporations such as Chase have ended leases to move workers to home or to their company-owned space on the outer belt. On the positive side, the conversion of Downtown Columbus office towers has begun as illustrated by the redevelopment of half of the 360,000 square feet of the PNC Tower into residential units by the Edwards Company. At $211 M, the second phase of the Scioto Peninsula development was among noteworthy proposals unveiled in 2021. It will include a 30-story residential tower, 245,000 square feet of office space, a parking garage, and street-level retail if new state funding can be gained. The White-Haines Madison block along High Street is being redeveloped by the Edwards Cos. The plan incorporates the former Madison’s department store and White-Haines buildings, as well as a new 15-story apartment building on a vacant lot to the north.

The graphic above from Colliers again illustrates that multi-family residential projects are popping up all over the Central Ohio region. Central Ohio and other mid-sized region’s residential growth prospects could be supported by the Work-From-Home (WFH) movement among companies and employers that are emptying traditional Downtown office buildings of tenants and creating concern among local government officials around the traditional flow of income and property taxes that are generated by Downtown office towers. Some estimates indicate that Columbus could lose as much as 30% of its income tax revenues due to WFH. The remodeling of Downtown office towers into residential units is possible but the costs to do so are substantial and parking restraints of Downtown Columbus and similar markets will be stretched even further with a large in-flow of Downtown residents.

The Central Ohio marketplace is booming and presents substantial market opportunities for residential development.