Housing developments can be a centerpiece of private investment that spur large community and small placemaking initiatives. The International Economic Development Council has defined placemaking as “the practice of enhancing a community’s assets to improve its overall attractiveness and livability.” Placemaking is defined as large-scale projects like the creation of new public or revitalized public spaces, alternative transportation infrastructure, pop-up retail, housing, or Downtown beautification projects. Bike trails, public beer gardens, parks, and other public spaces often mix uses and are attractive to residents and visitors alike. However, successful placemaking strategies require the use of multiple tools as well as an overall improvement in the quality of life available to area residents and visitors.

Five tools drive placemaking economic development strategies that transform communities, including:

- Historic preservation redevelopment.

- Parks and trail development.

- Landbanks that spur housing redevelopment.

- Housing development; and

- Economic development incentives drive Downtown district redevelopment.

Housing in the United States of America has become a hot button issue as of late. Most states are seeing historic price increases in multifamily and single-family residences since 2021. As demand for homes steadily increases the supply has not been able to keep up. The housing stock around the nation has been widely neglected in recent times. There has been a severe lack of new construction and prolonged underinvestment leading to a shortage of available housing. Developers are facing a multitude of issues making it difficult to get their boots on the ground. Residential developers like to state that there are three L’s to building residential properties. Land, labor, and lumber. All of which are harder to come by at this current time. So, what is next for our housing market?

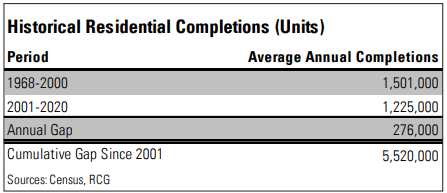

To begin let’s look at some of the data behind this current housing market situation. The total stock of U.S. housing grew at an average annual rate of 1.7% from 1968 through 2000. Recently, the U.S. housing stock grew by an annual average rate of 1% in the last two decades and only 0.7% in the last decade. What will it take to fill this gap in the underbuilding of homes across the United States? To negate the supply insufficiencies in the national housing market resulting from the past two decades of underbuilding, during the next 10 years, approximately 550,000 additional new housing units would need to be constructed per year over and above the historical trend of 1.5 million new units annually. One interesting statistic to note is that adults aged 25 to 34 years living at home with their parents increased by 2.5 million since 2010 and more than doubled from 2000 to 2020, increasing by 4 million people.1

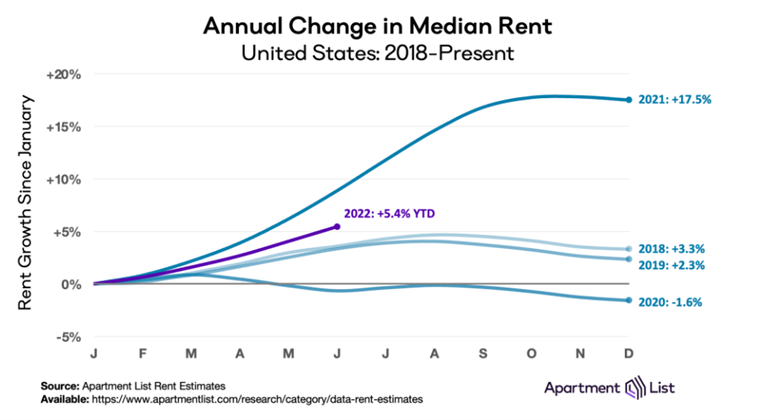

Are the multifamily rental markets faring any better during this time? According to a market study performed by Apartment List, multifamily properties rents have increased 5.4% across the United States so far in 2022. For comparison, the average rent growth from January to June was 3.1% in 2017, 3.6% in 2018, 3.4% in 2019, and -0.7% in 2020. The growth during 2021 was the highest in recent history increasing 8.8% over the first six months of the year and 17.5% over the entire calendar year. Production of two-to-four-unit structures fell by nearly 75% during the last two decades, when compared with the long-term average from 1968 to 2000. These smaller multifamily properties were consistently available to many Americans as more affordable homes and apartments. The steep drop-off in their construction has heightened the issue here in the United States. 2

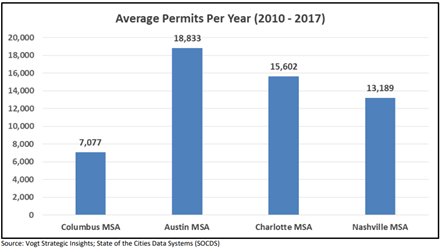

Is Columbus, Ohio faring any better amidst all this uncertainty going on? According to the Urban Land Institute and Mid-Ohio Regional Planning Commission, Central Ohio is expected to add as many as 1,000,000 people by 2050. Is there enough development currently underway to meet this demand? From 2010 to 2017 Columbus averaged 7,077 building permits per year. Other similar cities in the United States like Austin, Texas, Charlotte, North Carolina, and Nashville, Tennessee averaged 13,189 to 18,833 over this same time. If this level of the building continues through the next decades Columbus, Ohio will be unable to meet the rising demand. 3

Although, as scary as some of the points provided previously may seem the housing market is not doomed. The situation we are in is not like the infamous 2008 housing market crash. States and local governments are working towards fixing this problem. For example, there are now over 20 states with a statewide low-income housing tax credit (LIHTC) program in place. These programs vary greatly between states based on the wants and needs of the population living there. For example, one of the more interesting programs is the state of Illinois allowing individuals or organizations to receive a tax credit based on their donations to participating non-profit housing developers. Many other states are beginning to see the success of these state-level tax credit programs and are beginning to follow suit. There are other programs to incentivize developers into increasing the current level of development. Ohio law authorizes local governments to provide property tax abatements on new investments up to 100% through the Community Reinvestment Area (CRA) program that does not require local school board approval for districts created before 1994. The Ohio CRA program is an economic development tool administered by municipal and county governments that provides real property tax exemptions for property owners who renovate existing or construct new buildings. CRAs are areas of land in which property owners can receive tax incentives for investing in real property improvements. Another program is Ohio’s Special Improvement Districts (SID) which permits property owners in a defined area through a majority vote to create a special assessment to fund area public infrastructure improvements and provide services. Developers also need to understand where the available land and demand are before the building process can begin. Housing market studies can provide detailed information about a prospective area. Developers can gain insight into the demand for housing in an area, available land and infrastructure needed for future developments. Working with local government and economic development firms can help increase how successful these developments turn out.

Source :

1 https://cdn.nar.realtor/sites/default/files/documents/Housing-is-Critical-Infrastructure-Social-and-Economic-Benefits-of-Building-More-Housing-6-15-2021.pdf

2 https://www.apartmentlist.com/research/national-rent-data

3 http://www.biahomebuilders.com/aws/BIA/asset_manager/get_file/276766?ver=4243