The International Economic Development Council has defined placemaking as “the practice of enhancing a community’s assets to improve its overall attractiveness and livability.” Placemaking is defined as large-scale projects like the creation of new public or revitalized public spaces, alternative transportation infrastructure, pop-up retail, housing, or Downtown beautification projects. Bike trails, public beer gardens, parks, and other public spaces often mix uses and are attractive to residents and visitors alike. However, successful placemaking strategies require the use of multiple tools as well as an overall improvement in the quality of life available to area residents and visitors.

Five tools drive placemaking economic development strategies that transform communities, including:

- Historic preservation redevelopment.

- Parks and trail development.

- Landbanks that spur housing redevelopment.

- Housing development; and

- Economic development incentives drive Downtown redevelopment.

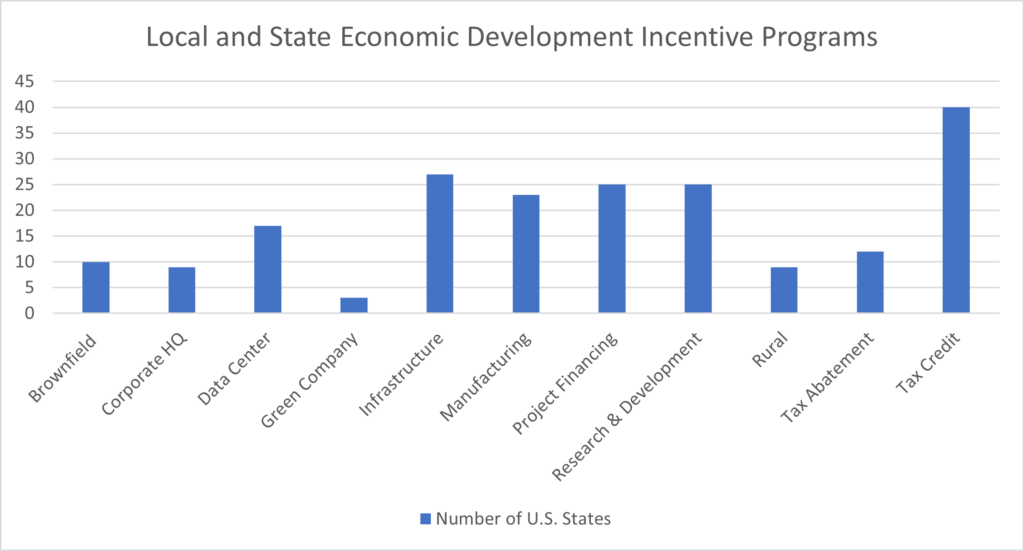

Local, state, and economic development incentives make many placemaking strategies a reality but providing the financing to get the projects completed. Princeton Economics estimates that state and local governments invest about $30 B dollars in economic development incentives annually.[i]

Tax credits are tools private developers, investors and individual companies use to reduce tax burdens in exchange for economic growth. Ohio’s Transformational Mixed-Use Development Program provides a tax credit against Development costs incurred during the construction of a project that will be a catalyst for future development in its area. A Development includes new construction and/or improvement of vacant buildings that will have a major economic impact on the site and the surrounding area. This Development must be a combination of retail, office, residential, recreation, structured parking, and other similar uses into one mixed-use Development. Projects may be either the entire Development or a phase or contiguous phases within the Development. Eligible applications will be divided based on location of the Development, resulting in two funding groups: “major city” and “general”. A Major City Project is located either within a major city, as defined in program guidelines, or within a ten-mile radius of the corporate boundary of the city. Developments that do not meet these location criteria will be considered General Projects. The Ohio Department of Development has $100 M in TMUD tax credits to award in each of the next two fiscal years.

To attract new businesses and encourage the expansion of existing businesses, state and local governments also may offer tax abatements as an economic development incentive. While this tax incentive has a general effect on property taxes, the means employed by state and local governments to achieve this effect varies from program to program. Enterprise Zones are the most common tax abatement program.[i] These programs offer real and personal tax incentives to businesses that expand or locate within designated “Enterprise Zones.” First, the locality must designate an area as an Enterprise Zone. Enterprise Zone designation is based upon an areas poverty and unemployment rate. However, state law may not limit which municipality may use the Enterprise Zone program; thus, Enterprise Zones are as prevalent in wealthy suburban communities as they are in the poor, inner city neighborhoods. This goes against the original intent of the Enterprise Zone program. Once designated, businesses that wish to build or expand in Enterprise Zones can apply for the program’s abatement. Generally, the tax incentive permits the local government to offer a full or partial exemption of the real or personal property values attributable to the new development.

Port authorities are governmental agencies with few of the restrictions placed on governments. Ports do not need a body of water or an airport to operate. Port authorities operate across the United States and provide services akin to a public bank providing a range of public finance tools critical to economic development projects. Three states have tax incentives designed to support the operation of local port authorities that include Alabama, Georgia, and Virginia. Arkansas, Ohio, and Wyoming also authorize port authorities to provide what is a sales tax exemption for the construction material in economic development projects that can produce substantial economic development savings.

Federal government tax credits and program funding are used to enhance economic growth. The U.S. Department of Commerce’s Economic Development Administration (EDA) public works grants fund infrastructure related to company attraction and expansion. The program supports locally developed projects that encourage long-term economic self-sufficiency and global competitiveness.[ii] These investments support redevelopment of Brownfield and business/industrial development. Public works and economic development programs support infrastructure for industrial park, port, and Brownfield development.[iii]

The federal opportunity zone program designated 8700 census tracts as opportunity zones. Taxpayers who invest their capital gains in a federal certified opportunity zone for ten years will not pay any capital gains taxes on that investment and can defer a smaller percentage they would have to pay in their original capital gain event. States also support opportunity zone investments. The state of Ohio created the state Opportunity Zone Investment Credit and the Ohio Qualified Opportunity Fund. The Ohio opportunity zone investment credit is a non-refundable credit that allows a taxpayer to invest capital gains in a qualified opportunity fund. The credit shall equal 10 percent of the taxpayer’s investment, capped at $1 M, in a qualified opportunity fund in the taxable year of the investment. The Ohio Development Services Agency Director cannot issue more than $50 million in Ohio Opportunity Zone Tax Credits over the biennium.

Federal New Markets Tax Credits provide a funding source for projects located in federally designated low-income areas. The Federal New Markets Tax Credit provides a 39% Federal Tax Credit Over 7 Years and $1M Ohio Tax Credit paired with Federal Credit for real estate investments in poor communities through complex transactions involving retail, office, and manufacturing projects. New Market Tax Credit projects involve the gaining of an allocation of the federally awarded tax credit from an awardee of the credit. The challenge for use of this program is the demand for projects far exceeds the availability of New Market Tax Credits.

The provision of infrastructure is the most traditional public subsidy provided by local and state governments to incentivize economic development. Infrastructure is the roads, water, sewer, rail, power, and telecommunications services needed to operate any use of a property. Government provides infrastructure for economic development projects either through their direct resources or through public finance tools that pay for infrastructure over a period.

Tax Increment Financing (TIF) is the most popular tool for local governments to finance public improvements within their districts or areas. TIFs started in California in the 1950s, and today, the District of Columbia and all of the states, other than Arizona, have adopted some form of TIF program.[iv] Local government pays for public improvements and infrastructure by capturing the future tax increments from the project’s area under a TIF.[v] The local government issues bonds to finance the project, and the bonds are paid for later through the increase in taxable property value the improved area receives.[vi] This increase in taxable property value is the “tax increment,” and it goes directly toward repaying the debt incurred by the local government on the issued bonds.[vii] TIF does not require an increase in taxes or a new tax levy. Generally, property taxes are the type collected, but a few states allow for other taxes, like sales taxes, to be included in the collection.[viii] The taxes are then placed in a special fund, which reimburses the principal and the interest of the issued bonds.[ix] Once the value of the property increases, the gain in the taxable value goes to the local government to repay the debt incurred by the issued bonds. Thus, if the process works as planned, the project is self-sustaining and provides a benefit to the community without any new or increased taxes.

TIF bonds are permitted to fund project costs and “public infrastructure.” What constitutes a public infrastructure varies from state to state. Public infrastructures is defined as improvements to land, streets, water lines, sewer facilities, buildings, bridges, highways, pedestrian walkways, storm drainage, traffic-related instruments, landscaping, schools, and parking structures.[x] More expansive jurisdictions allow for the funding of commercial, industrial, and residential structures.[xi] Further, the use of eminent domain to acquire land is permitted in most TIF projects. As to project costs, they typically encompass all necessary and incidental costs of a development project such as the costs of issuing obligations, relocating displaced persons, organizational costs, and professional services fees.[xii]

As the table below illustrates, states like Ohio offer substantial infrastructure and site development incentives.

A wide range of local, state, and federal government incentives exist that can finance transformational placemaking projects. Please contact Nate Green at [email protected] if you need assistance with utilizing economic development incentives for placemaking or other economic purposes.