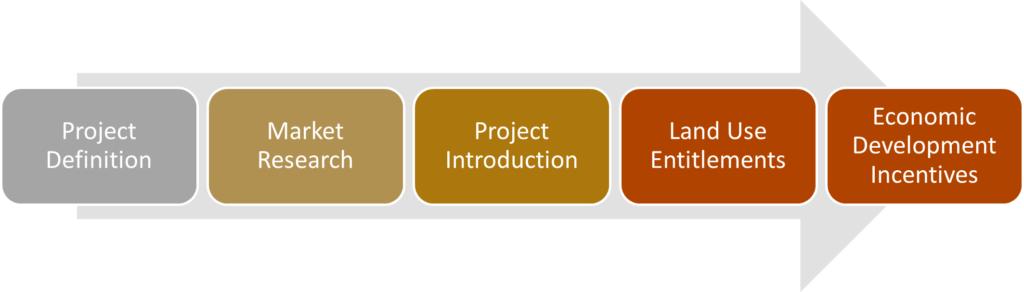

The corporate site location process decides where a company locates, and, while Princeton Economics estimates companies gain $30B in economic development incentives, this process is about a lot more than tax incentives and involves five distinct steps.

| Montrose Group Corporate Site Location Process |

Project Definition. Companies whose lease is expiring, have expected job growth and capital needs their current facility cannot accommodate, are consolidating facilities or following a customer or market trends to a new region or merging should undertake a corporate site location process. Companies need to determine the number of employees, wages and benefit costs of these employees, workforce skills needed for these employees, capital expenses for a facility, utility, parking, and other site needs.

Market Research. Market research targets regions that are growing economically, have a common industry cluster with the company, provide a skilled workforce and competitive cost of doing business. The goal of the market research is to target a small number of communities in which the company can locate a facility.

Project Introduction. Following the definition of the project and market research, the next step in the corporate site location process is to develop a project letter or Request for Proposal (RFP) for a targeted group of regions seeking market information, recommended sites and economic development incentive offers from regional economic development organizations, local and/or state government economic development leaders in a confidential process.

Land Use Entitlements. Any new site a company chooses to locate must be properly zoned for the intended use of the company and other land use entitlements such as annexation may also be required to gain essential public services such as water, sewer, and roads. Zoning is a democratic process with substantial public input and a vote of approval by local government officials. Annexation is different in each state but is an administrative process if the property owners seek the annexation.

Economic Development Incentives. Local, state, and federal government tax credits, tax abatements, grants and loans may all be provided in each of the fifty states as an incentive for companies creating jobs and providing capital investment. Issues such as remote work need to be addressed to determine if many economic development incentives will be applicable. Economic development incentives can support job creation and capital investment, redevelopment of historic structures, investments in distressed areas or Brownfield sites, provide funding for needed infrastructure, workforce development training, or just a pile of cash.

Contact Dave Robinson at [email protected] if you need assistance with a corporate site location project or other economic development matters.