The state of Ohio operating budget made substantial changes to state tax programs impacting corporate site location and economic development in the Buckeye State. These changes ranged from a state income tax reduction to changes in existing tax credit programs to modifications designed to grow venturer capital in the state.

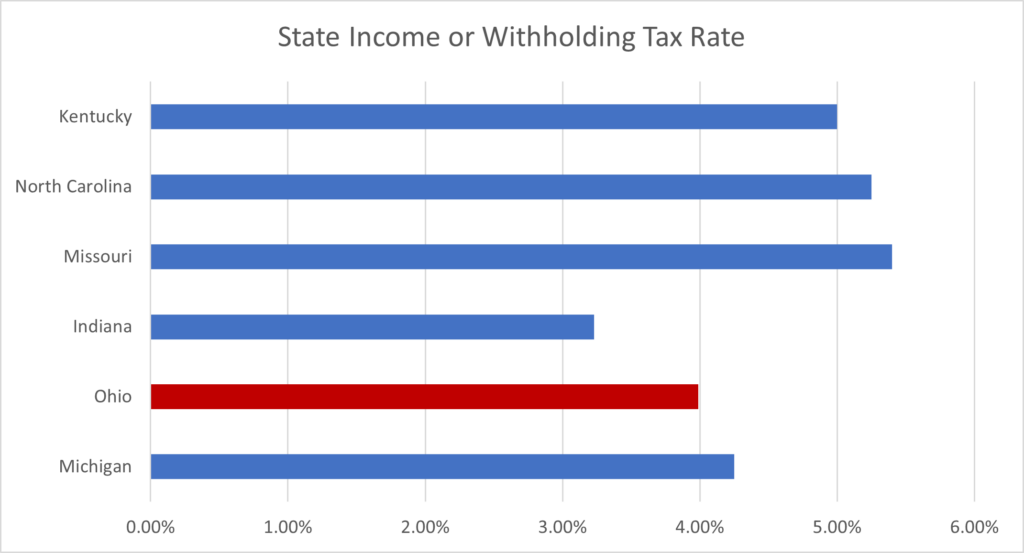

State Income Taxes. The most important state tax law change enacted in the newly approved state of Ohio operating budget relates to the reduction of the state income tax rate by 3% in tax year 2021 and thereafter. The new state of Ohio income tax eliminates the top bracket and further reduces the tax rate in the next-to-top bracket to 3.99% and increases the income level at which the lowest tax bracket begins to $25,000 in tax year 2021.

Ohio has continued to shift away from an income tax and rely more on consumption taxes such as the sales tax to operate their state government. The reduction in state of Ohio income tax helps them compete well with other states utilizing an income tax but more work needs to be done to compete with Florida, Texas and others that lack a state or local income tax.

Opportunity Zones. The state operating budget modified Ohio’s state Opportunity Zone tax credit program to allow the existing income tax credit for investments in federally authorized Ohio opportunity zones to increase from $1 M to $2 M the limit on the amount of credits that may be awarded to an individual during a fiscal biennium. A $50 M per fiscal biennium limit on issuance of tax credit certificates in current law is unchanged by the bill. The Ohio Opportunity Zone Tax Credit Program provides an incentive for taxpayers to invest in projects in the 320 federally certified Ohio Opportunity Zones. Federal Opportunity Zones offer three tax incentives to investors: a temporary tax deferral for capital gains reinvested in an Opportunity Fund– the deferred gain is recognized on the earlier of the date on which the opportunity zone investment is sold or December 31, 2026; a step-up in basis for capital gains reinvested in an Opportunity Fund– the basis of the original investment is increased by 10% if the investment in the qualified opportunity zone fund is held by the taxpayer for at least 5 years, and by an additional 5% if held for at least 7 years, excluding up to 15% of the original gain from taxation; and a permanent exclusion from taxable income of capital gains from the sale or exchange of an investment in a qualified opportunity zone fund, if the investment is held for at least 10 years.

Capital Gains. The state operating budget authorizes an income tax deduction, for taxable years beginning in and after 2026, for all or a portion of capital gains received by investors in certain Ohio-based “venture capital operating companies” (VCOCs) certified by the Director of Development. The state operating budget changes require that a VCOC, in order to qualify for certification, must manage, or have capital commitments of, at least $50 M in active assets and must have residents of Ohio constitute at least two-thirds of its managing and general partners, and it limits deductibility of gains to those that occur during the period for which the company is certified as an Ohio VCOC. The legislation provides that the deduction equals 100% of the capital gain received by the taxpayer in the taxable year from a qualifying interest in an Ohio VCOC attributable to the company’s investments in Ohio businesses and 50% of the capital gain received by the taxpayer from a qualifying interest in an Ohio VCOC attributable to the company’s investments in all other businesses.

Ohio Sales Tax Exemption for Temporary Workers. The state of Ohio operating budget provides an exemption for employment services (providing personnel to perform work under the supervision and control of the purchaser) and employment placement services (locating employment for a job-seeker or locating job candidates for an employer) from sales and use tax. This provides a substantial reduction in the tax burden not just for these temporary worker firms but the companies they serve. The state of Ohio and counties and other local political jurisdiction such as transit agencies utilize a sales tax to fund much of their governmental activity. The state of Ohio has a number of activities they choose to exempt from sales tax for a variety of public policy reasons. Ohio made substantial gains in changing their state tax code to support the retention and attraction of companies to the state. The Montrose Group has negotiated over $1 B in economic development incentives, including using many of these tax credit and other programs, and please contact Dave Robinson at [email protected] if you have any questions on this or other matters.