Remote working is here to stay. That certainly is the indication from surveys of business leaders that stems because of COVID 19. Forbes reported that a Gartner CFO survey revealed that over two-thirds (74%) plan to permanently shift employees to remote work after the Covid-19 crisis ends. Big Tech companies are leading the way—from Twitter to Square to Facebook— many technology-oriented companies are planning for remote work to continue in a post-COVID 19 economy. The same remote working trend will also impact advanced services companies such as banking, insurance, professional service, and similar white-collar firms. The big questions are how will remote work impact the economic growth of these companies and are local and state tax codes and economic development incentives structure to foster that growth? The answer to those questions need to be addressed through a smart corporate site location process as most state tax codes and incentives are working to catch up with a remote working model.

Let us start with how the tax code deals with remote workers. Traditionally, companies and their workers are taxed based upon their nexus or connection to a local and state jurisdiction. A company having income from business activity that is taxable in multiple states may be required to apportion its business income using an apportionment formula with equally-weighted property, payroll and sales factors. Some states permit a multistate corporation to use an alternative apportionment formula with a single sales factor. Many states with large cities on the border with another state enters into multi-state agreements that permits the state with the company location to tax their workers living in an adjoining state. Companies needs to understand how the company and their remote workers will be taxed.

Government provides essential public services and all parts of the world use a tax code to provide those services. What the government taxes matters to companies just as much as how high the tax rate is. Companies and their employees are exposed to a range of taxes that include property tax; sales tax; capital gains; excise tax on public utilities and insurance; corporate income tax; unemployment insurance tax; individual income tax on business; and license and other taxes. High-tech entrepreneurs will be more sensitive to income and capital gains taxes than they might be on a sales tax. A manufacturing with a large amount of inventory might fight a property tax that includes inventory particularly punishing. Retail companies are extremely sensitive to high sales taxes that may drive down consumer purchases. Policy makers can shape their tax code to attract the companies they seek to grow in their region. In general, economic development benefits from lower income taxes and shifting a greater reliance on consumption taxes like sales taxes. Who taxes is also a critical question for companies to consider when looking at the remote worker issue.

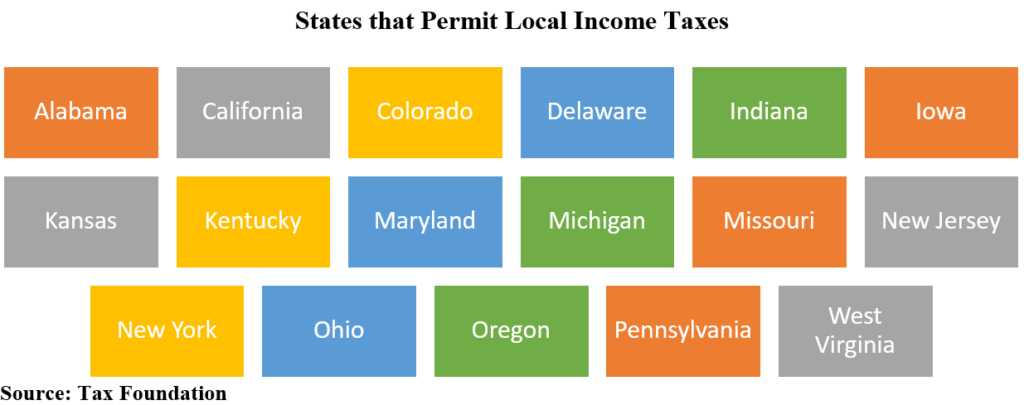

According to the Tax Foundation, local income taxes are imposed by 4,964 taxing jurisdictions across 17 states. Depending on the state, local income taxes may be levied by counties, municipalities, school districts, or special districts, with most levied by municipalities (3,816) and school districts (954). Six states rely on income taxes for more than 10 percent of local tax collections, while the local income taxes in five states capture more than 1 percent of adjusted gross income. Nonresidents are sometimes subject to a lower rate than residents, or not taxed at all, in recognition that they receive fewer benefits than do residents. In different states, local income taxes are levied on all income, earned income, or interest and dividend income. Some jurisdictions impose payroll taxes or dollar-denominated employment or occupational privilege taxes in lieu of a traditional income tax. Of course, some states that have no income tax end up taxing companies more from other activities—they can create a larger share of tax burden on companies than states with a moderate-income tax.

Source: 2020 Business Tax Burden, Council of State Taxation

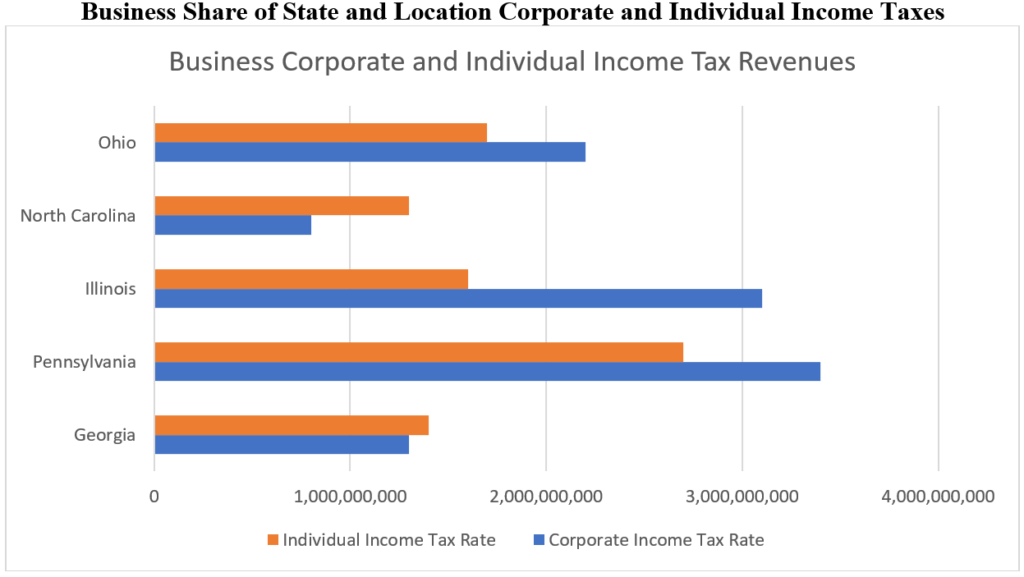

States of like size and economies illustrate the difference in their use of the income tax for corporations and individuals. Southern states like North Carolina and Georgia illustrate why they have a more attractive business environment with lower income taxes while Industrial Midwest states like Ohio, Illinois and Pennsylvania have struggled to retain and attract economic investment compared to the south in part due to high local and state government income tax rates—in particular, municipalities in Ohio operate on the city income tax. These Southern states will be attractive to projects that include remote work based upon their low corporate and individual income tax rates.

States like Ohio, Illinois and other high-income tax states will be forced to use economic development incentives to retain and attract companies seeking to move to more of a remote work model. Illinois has some work to do to prepare for this new office model. Illinois state economic development incentives are based on new jobs created or retained as done by most state. Pennsylvania follows a similar model. Unfortunately for the world of remote working, the number of jobs created or retained and the payroll base for determining the size of the credit are based on employees who work on-site at the establishment for which the credits are awarded. Due to COVID 19, the state of Illinois has allowed companies whose workers are temporarily working remotely to include those employees in the calculation of their incentive if they expect that those employees will return. A permanent allowance for remote workers to be included in this calculation would require a statutory and regulatory change. This is a change Illinois needs to make. Illinois is not alone. Missouri requires workers to be at an office in state 51% of their time to be eligible for economic development incentive awards and then there is the other end of the scale with Tulsa Remote (https://tulsaremote.com/) who is offering to pay remote workers $10,000 to move and work remotely in Tulsa. Ohio is in much better shape than Illinois, Missouri and other states when it comes to using economic development incentives for remote workers. The Ohio Job Creation Tax Credit that provides for awards approved after 9/29/17 businesses may include “qualifying work-from-home employees” for purposes of calculating their benefit amount. JobsOhio as a private sector economic development corporation has wide latitude to structure their economic development incentives as they wish related to remote workers as does Texas and other states with large “closing funds.” Those states seeking tech and advanced service workers need to build in remote worker flexibility into their regulations.

Injecting remote workers into local tax incentives has a larger set of challenges than figuring out state tax incentives. States should truly only care about jobs being created in their states—those are workers paying taxes, buying houses, cars and other consumer goods that keep a community running. Remote workers who liver in multiple local jurisdictions do not have that same advantage for local governments. Home Rule cities as in Ohio and elsewhere can award municipal income tax credits to rebate back a portion of the income tax generated by companies and employees to companies committed to job growth. Those incentive agreements can be structured to include all workers who live in the city. But many local governments tax those who work in the city as well as residents. During the COVID 19 crisis, cities in Ohio are still collecting income tax on people who are not actually working in their city as many companies and governments have instituted work for home orders—many a Downtown office tower is nearly empty of workers but their suburban workers are still paying city taxes.

States like Virginia and others who do not have a municipal income system also struggle with remote workers and tax incentives. Virginia’s local governments depend heavily on property taxes. The reduction in office use will drive down substantially the value of office space and buildings and reduce the taxes generated. The Return-on-Investment analysis that justifies the use of economic development incentives for these communities is in jeopardy when remote workers reduce substantially the value of the property tax increase driven by new economic development projects. This is even more complex for states like Indiana and others that permit municipal income tax but only permit a tax to be levied based upon where you live not where you work. Large urban centers like Downtown Indianapolis will struggle more and high-wealth suburban centers like Carmel and Fishers, Indiana will gain more revenue as more of their residents are able to remote work.

The end of the remote working story and company growth is not finished. It is just starting. Companies considering a remote working model are going to need to really think through not just the economic and demographic factors that make a market attractive for investment but how local and state tax structure and the flexibility of tax incentives impact this important decision.

Please contact Dave Robinson at [email protected] if you have any corporate site location questions.