Saving historic structures can be a key element to an economic development strategy—especially when it comes to redevelop rural Downtowns whose walkable areas are attractive to younger workers. For 41 years the U.S. National Park Services, in partnership with the State Historic Preservation Offices, has administered the Federal Historic Preservation Tax Incentives Program. The redevelopment of historic properties create a unique opportunity to spur economic growth through the attraction of Millennials to live, work and play. Most established Central Business Districts are home to arts, museums, office, and other historic properties primed for redevelopment opportunities and are essential for attracting Millennials much more focused on the quality of place than wage of a job.

The Federal historic preservation tax credit program provides a 20% Federal tax credit to property owners who undertake a substantial rehabilitation of a historic building in a business or income-producing use while maintaining its historic character, and is often matched by state historic preservation tax credits.[i] The historic tax credit is designed to preserve and rehabilitate historic buildings, and to also promote the economic revitalization of older communities in the nation’s cities and towns, along Main Streets, and in rural areas.[ii] Most states, 37 to be precise, offer a historic preservation tax credit that enhances the value of the federal credit. State historic preservation tax credits work hand in hand with the federal historic preservation tax credit and can provide a substantial boost to redeveloping historic properties. Michigan, Missouri, and Ohio operate state historic preservation tax credit programs worthy of review.

Missouri Historic Preservation Tax Credit. Missouri’s historic preservation tax credit has been available since 1998.[iii] Both income and owner-occupied properties may qualify for a 25% Missouri tax credit, and the State Historic Preservation Office is responsible for reviewing and approving rehabilitation work for the state credits.[iv] Any taxpayer is eligible to participate in this program, and not-for-profit entities and government entities are ineligible.[v] Any participation by not-for-profit entities, including but not limited to ownership interest, capital contributions, distribution of tax credits, incurrence or payment of rehabilitation expenses, lease to a tax-exempt entity, may result in the reduction of tax credits.[vi] An eligible property must be listed individually on the National Register of Historic Places, certified by the Missouri Department of Natural Resources as contributing to the historical significance of a certified historic district listed on the National Register, or of a local historic district that has been certified by the U.S. Department of the Interior.[vii] The costs and expenses associated with the rehabilitation must exceed 50% of the total basis of the property (acquisition cost).[viii] The federal and state credits can be used in combination for the rehabilitation of commercial or income-producing properties, and rehabilitation of non-income producing residential properties qualifies for the state credits only.[ix] State legislation created changes in the Missouri state historic preservation tax credit program including, after effective date of legislation, August 28, 2018, reducing the overall project funding cap to $90M in funding with an additional $30M solely for projects located in a qualified census tract.[x] There is a $250,000 cap for tax credits for non-income producing, single family, owner-occupied residential properties but no transaction caps on other eligible projects.[xi] From a process standpoint, an application is submitted to the Missouri Department of Economic Development, which will then be submitted to the State Historic Preservation Office to determine the eligibility of the property and proposed rehabilitation, based on the standards of the U.S. Department of the Interior. Preliminary applications subject to the cap will be scored by DED with tax credits award in two cycles annually.[xii] Projects receiving less than $275,000 in credits may be accepted at any time.[xiii]

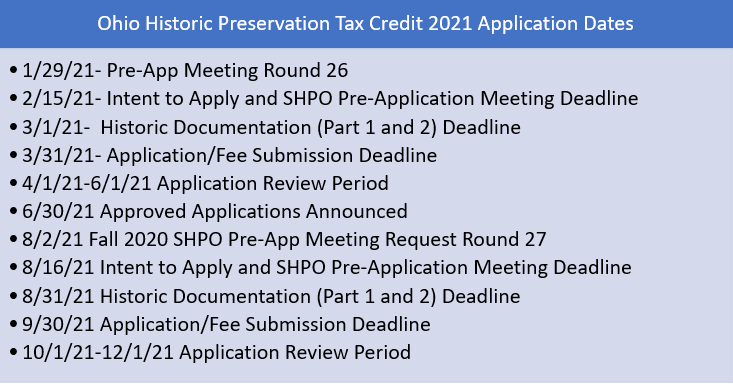

Ohio Historic Preservation Tax Credit. Ohio’s Historic Preservation Tax Credit Program is administered by Ohio’s Development Services Agency.[xiv] The program provides $60 M in tax credits for the rehabilitation expenses incurred by owners of historically significant buildings located across the state, and the tax credits subsidize up to 25% of qualified rehabilitation expenditures for historic rehabilitation projects, capped at $5 million per project for a small number of catalytic projects. [xv] Projects must be a certified historic structure, have a redevelopment plan consistent with its historic roots and be certified by the Ohio Office of Historic Preservation. Ohio is full of potential historic redevelopment projects including: 48 certified national historic city halls; 51 certified national historic theaters; 59 certified national historic courthouses; 91 certified national historic college/university buildings; 139 certified national historic hotels; 179 certified national historic museums; and 239 certified national historic office buildings.[xvi] The program is highly competitive and receives applications bi-annually in March and September.[xvii]

Michigan breathed life again into its dormant state historic preservation tax credit program. Senate Bill 54 passed the Michigan General Assembly and was signed into law by Governor Whitmer at the end of 2020. Senate Bill 54 provides a historic preservation tax credit of up to 25% of qualified expenditures on the rehabilitation of historic buildings, structures, and sites. The bill would essentially reinstate a tax credit that was eliminated beginning in 2012. The State Historic Preservation Office (SHPO)1 would have to certify the property and rehabilitation. The total of all preapproved credits could not exceed $5.0 million in a calendar year, and no taxpayer could claim a credit of more than $2.0 million for a single property.

Specifically, the bill would allow a qualified taxpayer with a certificate of completed rehabilitation issued after December 31, 2020, and before January 1, 2031, to claim a tax credit for qualified expenditures for the rehabilitation of a historic resource under the rehabilitation plan in the year the certificate is issued. A qualified taxpayer would mean a person that either owns the historic resource to be rehabilitated or has a long-term lease agreement with the owner of that resource and that has qualified expenditures that meet either of the following: for the rehabilitation of a residential historic resource, qualified expenditures of at least $1,000; for the rehabilitation of a historic resource other than a residential historic resource, qualified expenditures equal to or greater than 10% of the state equalized valuation (SEV) of the property or relevant portion of the property. Historic resource would mean a publicly or privately owned historic building, structure, site, object, feature, or open space that meets either of the following: it is located in a historic district designated by the National Register of Historic Places, the state register of historic sites, or a local unit acting under the Local Historic Districts Act; it is individually listed on the state register of historic sites or the National Register of Historic Places. A Long-term lease would mean a lease term of at least 27.5 years for a residential resource and 31.5 years for a nonresidential resource. Qualified expenditures would mean capital expenditures that qualify for a rehabilitation credit under section 47(a)(2) of the Internal Revenue Code (the federal credit) or that would qualify under that section except that they were for a historic resource that is not eligible for that credit. Qualified expenditures would include only those paid or incurred during the time periods prescribed for the federal credit and any related Treasury regulations. Expenditures for nonhistoric additions to a historic resource would not qualify unless required by state or federal historic preservation, safety, or accessibility regulations. Historic district would mean an area, or group of areas not necessarily having contiguous boundaries, that contains a resource or group of resources related by history, architecture, archaeology, engineering, or culture. Residential historic resource would mean a non–income-producing historic resource that is an owner-occupied dwelling.

A qualified taxpayer could claim a credit equal to 25% of the taxpayer’s qualified expenditures. The taxpayer would have to initially claim a credit within five years after issuance of the certificate of completed rehabilitation, after which time the certificate would no longer be valid and the taxpayer could no longer claim a credit for that rehabilitation plan. Michigan’s program regulations and application are still being developed and the program which has a very small amount of tax credits available hopefully will receive additional funding by the state to enhance the program’s impact.