COVID 19 has brought the forefront how the United States financing small businesses. According to the U.S. Small Business Administration the United States has over 30 M small business, firms with fewer than 500 workers, employing nearly 60 M Americans or nearly half of the nation’s workforce. Eighty-one percent, or 24.8 M, had no employees, and nineteen percent, or 5.9 M, had paid employees as measured by the SBA in 2017. Prior to COVID 19, small business was growing at a strong rate. According to the SBA, from 2000 to 2018, small businesses created 9.6 M net new jobs while large businesses created 5.2 M. Thus, they accounted for 64.9% of net new job creation in the period. Small business is a critical part of the American economic engine.

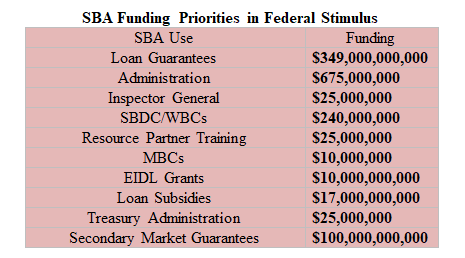

The passage of the federal Stimulus legislation has substantial changes to the U.S. Small Business Administration which should make this organization a prime stop for companies, sole proprietors, independent contractors, self-employed, tribal business, 501 (c)(3), or a 501 (c)(19) veterans organization with less than 500 employees (full time, part time or other status) seeking financing. Also eligible for SBA funding are companies in the accommodation and food services sector (NAICS 72) with less than 500-employeeson a per physical location basis, and, if operating as a franchise or receive financial assistance from an approved Small Business Investment Company the normal affiliation rules do not apply. The Small Business Administration gains a substantial funding increase and has added new flexibility for its 7 (a) loan program and sees the creation of new programs to meet small businesses needs during COVID 19.

Gaining small business financing tied to COVID 19 involves first understanding what new regulatory and funding changes the federal Stimulus legislation provided. First, let’s look at the substantial enhancements to several SBA programs made by the federal Stimulus legislation.

Economic Injury Disaster Loans (EIDL). The EIDL SBA program provides up to $2 M per borrower in working capital loans for small businesses and requires small businesses must meet a list of size standards which vary per NAICS industry code. The federal Stimulus legislation does the following related to the EIDL program:

⦁ Funding Allocation. Provides $10 B for EIDL emergency grants;

⦁ Eligibility. Expands eligibility for access to EIDL to include Tribal businesses, cooperatives, and ESOPs with fewer than 500 employees or any individual operating as a sole proprietor or an independent contractor during the covered period (January 31, 2020 to December 31, 2020), and private non-profits are also eligible for both grants and EIDLs.

⦁ Loan Terms. Requires that for any SBA EIDL loans made in response to COVID-19 before December 31, 2020, the SBA shall waive any personal guarantee on advances and loans below $200,000, the requirement that an applicant needs to have been in business for the 1-year period before the disaster, and the credit elsewhere requirement.

⦁ Loan Approval Criteria. During the covered period, allows SBA to approve and offer EIDL loans based solely on an applicant’s credit score, or use an alternative appropriate alternative method for determining applicant’s ability to repay.

⦁ Emergency EIDL Grant. Establishes an Emergency Grant to allow an eligible entity who has applied for an EIDL loan due to COVID-19 to request an advance on that loan, of not more than $10,000, which the SBA must distribute within 3 days, establishes that applicants shall not be required to repay advance payments, even if subsequently denied for an EIDL loan, in advance of disbursing the advance payment, the SBA must verify that the entity is an eligible applicant for an EIDL loan, this approval shall take the form of a certification under penalty of perjury by the applicant that they are eligible, outlines that advance payment may be used for providing paid sick leave to employees, maintaining payroll, meeting increased costs to obtain materials, making rent or mortgage payments, and repaying obligations that cannot be met due to revenue losses, requires that an advance payment be considered when determining loan forgiveness, if the applicant transfers into a loan made under SBA’s Paycheck Protection Program, and terminates the authority to carry out Emergency EIDL Grants on December 30, 2020.

⦁ Authority. establishes that an emergency involving Federal primary responsibility determined to exist by the President under Section 501(b) of the Stafford Disaster Relief and Emergency Assistance Act qualifies as a new trigger for EIDL loans and, in such circumstances, the SBA Administrator shall deem that each State or subdivision has sufficient economic damage to small business concerns to qualify for assistance under this paragraph and the Administrator shall accept applications for such assistance immediately. Adds “emergency” explicitly into other existing EIDL trigger language under Section 7(b)(2) of the Small Business Act.

Paycheck Protection Program (PPP). Makes temporary changes to the SBA 7(a) loan program by creating a new subset of 7(a) loans called Paycheck Protection Program loans. This program provides lenders 100% loan guarantees for loans of up to $10 M per small business for payroll losses and select working capital costs. While administered by SBA, loans are issued by private lenders. Under PPP, small businesses are defined as having less than 500 employees or meet SBA NAICS code size standards. The Federal stimulus includes the following provisions for PPP loans:

⦁ Funding. Provides $349 B in new funding for the 7(a) Program through December 31, 2020;

⦁ Loan Terms. Increases the government guarantee of all 7(a) loans to 100 percent through December 31, 2020 after which point the guaranty percent will return to 75 percent for loans exceeding $150,000 and 85 percent for loans equal to or less than $150,000, and establishes the maximum loan size as equivalent to 250 percent of the employer’s average monthly payroll costs (e.g., roughly 10 weeks of payroll expenses) or $10 M, whichever is less through December 31, 2020, provides a limitation on a borrower from receiving this assistance and an economic injury disaster loan through SBA for the same purpose; however, it allows a borrower who has an EIDL loan unrelated to COVID-19 to apply for a PPP loan, with an option to refinance that loan into the PPP loan but the emergency EIDL grant award of up to $10,000 would be subtracted from the amount forgiven under the Paycheck Protection Program, requires eligible borrowers to make a good faith certification that the loan is necessary due to the uncertainty of current economic conditions caused by COVID-19, they will use the funds to retain workers and maintain payroll, lease, and utility payments; and are not receiving duplicative funds for the same uses from another SBA program, waives both borrower and lender fees for participation in the Paycheck Protection Program and the credit elsewhere test for funds provided under this program, collateral and personal guarantee requirements under this program, outlines the treatment of any portion of a loan that is not used for forgiveness purposes and the remaining loan balance will have a maturity of not more than 10 years, and the guarantee for that portion of the loan will remain intact, sets a maximum interest rate of four percent, ensures borrowers are not charged any prepayment fees, allows complete deferment of 7(a) loan payments for at least six months and not more than a year, and requires SBA to disseminate guidance to lenders on this deferment process within 30 days, increases the maximum loan for an SBA Express loan from $350,000 to $1 M through December 31, 2020, after which point the Express loan will have a maximum of $350,000; and requires veteran’s fee waivers for the 7(a) Express loan program to be permanently waived.

⦁ Eligibility. Available for small businesses and nonprofits with fewer than 500 employees with one or more location, below a gross annual receipts threshold in certain industries, waves affiliation rules for businesses in the hospitality and restaurant industries, franchises that are approved on the SBA’s Franchise Directory, and small businesses that receive financing through the Small Business Investment Company (SBIC) program for a covered loan period as beginning on February 15, 2020 and ending on June 30, 2020, for eligibility purposes, requires lenders to, instead of determining repayment ability, which is not possible during this crisis, to determine whether a business was operational on February 15, 2020, and had employees for whom it paid salaries and payroll taxes, or a paid independent contractor;

⦁ Loan Uses. Specifies allowable uses of the loan include payroll support, such as employee salaries, paid sick or medical leave, insurance premiums, and mortgage, rent, and utility payments;

⦁ SBA 7 (a) Lenders. provides delegated authority, which is the ability for lenders to make determinations on borrower eligibility and creditworthiness without going through all of SBA’s channels, to all current 7(a) lenders who make these loans to small businesses, and provides that same authority to lenders who join the program and make these loans;

PPP Loan Forgiveness. The principal amount of a PPP loan will be eligible for forgiveness (subject to submission of proper documentation) up to an amount equal to the total of the following costs incurred and/or payments made during the eight-week period following the origination of the loan.

⦁ Funding. Provides $ 100 B for secondary market loan guarantees

⦁ Eligibility. Establishes that the borrower shall be eligible for loan forgiveness equal to the amount spent by the borrower during an 8-week period after the origination date of the loan on payroll costs, interest payment on any mortgage incurred prior to February 15, 2020, payment of rent on any lease in force prior to February 15, 2020, and payment on any utility for which service began before February 15, 2020;

⦁ Loan Forgiveness Terms. Amounts forgiven may not exceed the principal amount of the loan, eligible payroll costs do not include compensation above $100,000 in wages, forgiveness on a covered loan is equal to the sum of the following payroll costs incurred during the covered 8-week period compared to the previous year or time period, proportionate to maintaining employees and wages:

⦁ Payroll costs plus any payment of interest on any covered mortgage obligation (which shall not include any prepayment of or payment of principal on a covered mortgage obligation) plus any payment on any covered rent obligation + and any covered utility payment;

⦁ The amount forgiven will be reduced proportionally by any reduction in employees retained compared to the prior year and reduced by the reduction in pay of any employee beyond 25 percent of their prior year compensation;

⦁ To encourage employers to rehire any employees who have already been laid off due to the COVID-19 crisis, borrowers that re-hire workers previously laid off will not be penalized for having a reduced payroll at the beginning of the period;

⦁ Allows forgiveness for additional wages paid to tipped workers;

⦁ Borrowers will verify through documentation to lenders their payments during the period. Lenders that receive the required documentation will not be subject to an enforcement action or penalties by the Administrator relating to loan forgiveness for eligible uses;

⦁ Upon a lender’s report of an expected loan forgiveness amount for a loan or pool of loans, the SBA will purchase such amount of the loan from the lender;

⦁ Canceled indebtedness resulting from this section will not be included in the borrower’s taxable income; and

⦁ Any loan amounts not forgiven at the end of one year is carried forward as an ongoing loan with terms of a max of 10 years, at max 4% interest and the 100% loan guarantee remains intact.

Subsidy for Certain SBA Loan Payments. A special loan subsidy is provided for covered SBA loans to include existing 7(a) (including Community Advantage), 504, or microloan products.

⦁ Funding. Provides $17 B for loan subsidies;

⦁ Loan Subsidy Terms. Requires the SBA to pay the principal, interest, and any associated fees that are owed on the covered loans for a six-month period starting on the next payment due, loans that are already on deferment will receive six months of payment by the SBA beginning with the first payment after the deferral period, and loans made up until six months after enactment will also receive a full 6 months of loan payments by the SBA. SBA must make payments no later than 30 days after the date on which the first payment is due, requires the SBA to still make payments even if the loan was sold on the secondary market; and requires SBA to encourage lenders to provide deferments and allows lenders, up until one year after enactment, to extend the maturity of SBA loans in deferment beyond existing statutory limits.

No matter where the money comes from, the Montrose Group advocates for small business financing through a quick four step process.

Business Plan Review. First, a company’s business plan from a strategy and financial standpoint is reviewed to understand its basic market fundamentals and how the company achieves is sustainable competitive advantage. The business plan review includes:

⦁ Review of business strategy and financial analysis of company’s existing business plan;

⦁ Review of annual financial reports to identify cost and revenue centers; and

⦁ Identification of business development strategies to identify company’s ideal customer.

Financing Options. Following the review of a company’s business plan, next financing options are reviewed that best fit the short and long term needs of the organization. The majority of small businesses are eligible for SBA and other government loan programs, but the SBA program excludes companies in the gambling, lending, life insurance, religious teaching, primarily political and lobbying activities, oil wildcatting, mining, mortgage servicing, real estate development, bail bond, pawn or private clubs industries. Steps in the review of financing options include:

⦁ Determining the size of the company and industry focus;

⦁ Understanding the company’s financial needs such as whether they are for working capital or fixed assets; and

⦁ Mapping out private banking options as well as state and federal government program options and comparing the financing sizes and the cost of capital.

Financing Applications. Whether the financing is from a private or public source, a small business is going to need to file an application to request the financing. A list of documents and materials will be needed to file this application that includes:

⦁ Business financial statements to include three years of annual profit & loss statements, year-end balance sheet including a debt schedule, reconciliation of net worth, interim balance sheet, interim profit & loss statements, projected financial statements that include month to month cash flow projections, for at least a one-year period;

⦁ Business certificated and/or license;

⦁ Loan application history;

⦁ Income tax returns for the previous three years;

⦁ Resumes for each principal in the company;

⦁ Business overview and history including an explanation of why the SBA loan is needed and how it will help the business; and

⦁ Business facility lease.

Financing Advocacy

Finally, COVID 19 will flood both private and public sources of small business financing with applications. Firms like the Montrose Group will become not just business advisors but advocates with those financing sources to push for quick financing for the small businesses impacted by COVID 19 and, often, in need of this financing to have a business left when the current public health scare subsides.

Contact Jamie Beier Grant at [email protected] at the Montrose Group if you have a question about small business or nonprofit financing.